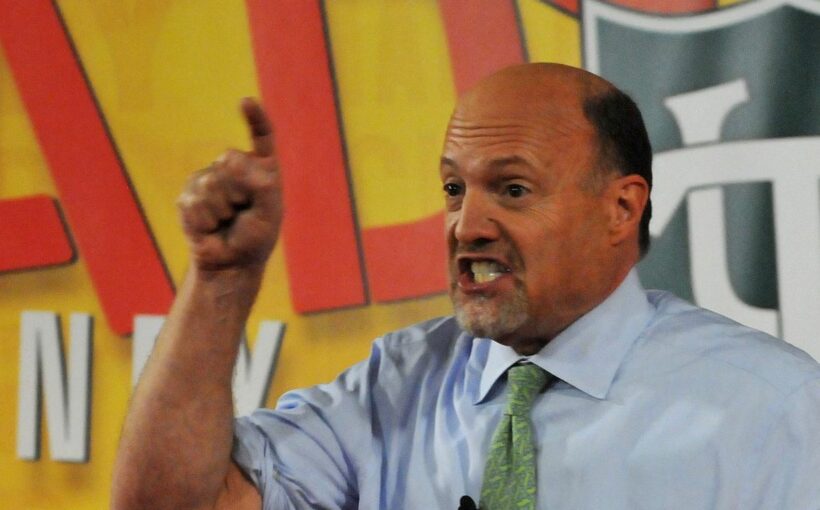

The broad markets pushed higher at the close on Thursday. The tech sector saw a handy gain on the day, precipitating a sizable move in the Nasdaq as well. Crude oil was more or less stagnant, holding right at $70 a barrel, and Bitcoin seems to be leveling out. All this makes for a stock picker’s market, and who better to pick these stocks than CNBC’s Jim Cramer.

Cramer has been a force in the market for years, dishing out advice and analysis to savvy investors. He makes no bones about how he encounters the market with well-founded technical and fundamental analysis at a level to which many a trader and investor aspire.

It is no secret that Cramer has been a fount not just for breaking news surrounding everyone’s favorite stocks and companies, but he actively engages and encourages more people to get their money to work for them via smart investing. With the recent surge in meme stocks and interest in cryptocurrencies, Cramer has shifted and grown with the times. He even has investment strategies on the cutting edge.

Cramer has maintained a popular show on CNBC for years now, Mad Money, that many people watch to make sense of the daily market moves. He also runs the popular finance website TheStreet.com. Furthermore, you can see him make appearances on other shows over the course of the trading day on CNBC. When not on the air, you can find him on Twitter dishing out even more knowledge.

24/7 Wall St. has compiled and distilled some of Cramer’s top picks and analysis here:

ZIM Integrated Shipping Services Ltd. (NYSE: ZIM) was called too hot for Cramer. He noted the massive run that the stock has seen recently and is waiting for the stock to cool off in the meantime. “I want you to just walk away for a little bit. I think it can go lower.” The stock closed up about 2.5% at $44.87 a share, in a 52-week range of $11.34 to $47.37. The consensus price target is $44.90.

Kadmon Holdings Inc. (NASDAQ: KDMN) has been the subject of “big-time speculation,” according to Cramer. He noted, “Please, understand that’s an up 10, down 10.” So take it how you will. The stock closed up 2.7% at $4.21 and has a 52-week range of $3.14 to $5.73. Analysts have a consensus price target of $12.17.

Cramer focused on International Business Machines Corp. (NYSE: IBM) CEO Arvind Krishna and said that if you are going for growth with this company, Jimmy Chill thinks there will be growth. Shares last closed at $150.54 a share, with a consensus price target of $143.82. The 52-week trading range is $105.92 to $152.84.

BP Midstream Partners L.P. (NYSE: BPMP) seemed to be the major call on the show. “These are the kinds you have to be buying. I like Enterprise, I like Oneok, I like this whole group. Why? Because after what I saw today with the Keystone, they ain’t never going to be able to get another pipeline approved in this country, so the ones that are existing are going to make money now.” The stock was last seen at $14.85, in a 52-week range of $9.30 to $14.99. The consensus analyst target is $14.80.

Trade Desk Inc. (NASDAQ: TTD) was a favorite of Cramer, as the stock has come down recently. Investors should remember those kinds of high-multiple stocks aren’t exactly popular now, but even though it is one of the most expensive stocks in the market, Cramer is sticking by it. The stock was last seen up about 1% for the day to $590.27, in a 52-week range of $343.04 to $972.80. The consensus price target is $670.74.

ALSO READ: Why the 5 Highest-Yielding Dow Stocks Are Great Second-Half Buys

Get Our Free Investment Newsletter

Source: Read Full Article