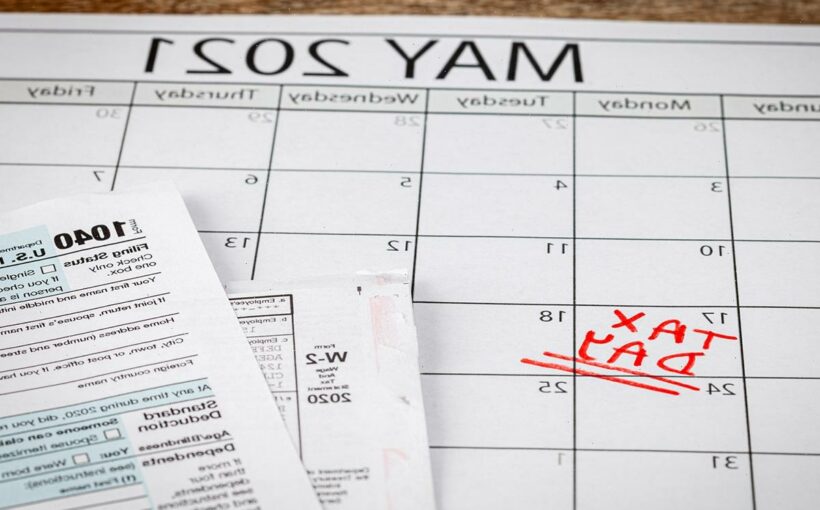

THE deadline for filing federal and state returns is on Monday, but you can file tax returns beyond that due date in some states.

The Internal Revenue Service (IRS) has postponed the original filing deadline from April 15 to May 17 due to issues with staffing, old systems, and the agency’s preoccupation with sending out stimulus checks.

But if you are living in Iowa, Maryland, or Oklahoma you are eligible to receive an additional deadline extension beyond May 17, USA Today reported.

Around 3.5million taxpayers in Maryland have until July 15 to file their returns, according to the Comptroller of Maryland.

Following the February winter storm that devastated a number of states nationwide, the IRS decided to extend the Oklahoma state tax return deadline to June 15 to help victims affected by the storm.

In Iowa, taxpayers have until June 1 to file their state tax returns, according to the Iowa Department of Revenue.

Director of Revenue Kraig Paulsen said in March that the extension is meant to help Iowans who have been impacted by the disruption caused by the coronavirus pandemic, even though the state economy is showing some signs of recovery.

Additionally, the first $10,200 of unemployment compensation income will be excluded from taxation for eligible taxpayers in Iowa.

You don’t have to worry at all about filing state taxes if you live in one of the states that don’t collect income taxes including Florida, Nevada, Alaska, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.

The IRS previously pushed back its tax filing deadline to July 15 last year amid high job loss rates during the early months of the pandemic.

If you have already filed your taxes you could receive a surprise stimulus check if you are eligible for stimulus payments.

Over a million payments have been sent out to people across the country as the IRS has released its latest batch of checks.

If you have recently filed your taxes, there are two ways you may receive some extra cash.

You may still be waiting for your stimulus check if the IRS has out-of-date bank details.

Americans should submit a Recovery Rebate Credit form and the stimulus money will be added to any rebate you are due.

The Recovery Rebate Credit section on the Internal Revenue Service's website offers a comprehensive, step-by-step guide on how to submit for the tax credit.

Most read in News

COP'S HORROR DEATH Female deputy, 22, found shot dead in her blazing home as man arrested

Shock moment powerlifter's arm SNAPS and bone breaks as she squats 369 pounds

Huge update in missing girl case as cops reveal when she was last seen

Everything to know about Lauren Smith-Fields and her death

4

4Individuals must file a 2020 tax return to claim the Recovery Rebate Credit even if you're not required to file.

The "recovery rebate" allows people who didn’t receive their stimulus checks to claim their payments on their 2020 tax return.

If you plan to do this, you must be quick as Tax Day is on Monday.

Source: Read Full Article