However, in addition to the most popular method of earning the so-called HODL (hold), there are many other ways to increase one’s capital by cryptocurrencies. What are they? Let’s have a look:

1) Stacking

Stacking is a way for getting passive income, in which users store coins on the Proof of Stake (PoS) algorithm and ensure the blockchain is operational. It gives them the right to make a profit. This option is only available to cryptocurrencies that run on PoS, such as EOS, Tezos, TRON and Cosmos. In the future Ethereum, the largest altcoin (in terms of capitalization plans) is planning to switch to the PoS algorithm. However, now you can stake the coins of the OKEX – CRO on their platform and receive passive earnings, or make a deposit on the ETH 2.0 contract and become a validator of the future ETH on the POS algorithm.

To put it simply, the point of stacking is that you block a certain number of coins, but in return, you receive coins from the system with full liability for staking on the platform. The main disadvantage here is clear – you cannot get your coins before the agreed expiration date of the contract.

Unlike mining, which is not sustainable at all, staking is eco-friendly, if we can say so. In 2021, a lot of people criticised Bitcoin, exactly for its non-environmental orientation.

2) Invest in coins at early stages

When diversifying your crypto portfolio, a brilliant solution would be to invest a small part of it in speculative coins, before they appear on Binance. Most likely, everyone has heard that, after listing on Binance, some coins take off by thousands of percent in hours, and many of them do not reach Binance, and a lot generally turn out to be a hoax, but 1 successful project will pay off all your losses many times over.

But how to find such projects and buy their coins BEFORE they appear on Binance?

You can find some of them on CoinList, for instance. There’s information about the tokenomics, the company and the team behind these projects as well, so you can decide which ones you are willing to invest in.

Also, many teams have Twitter, where they post regular updates, share plans for the future and current news. You can even send them a personal message but keep risks in mind.

3) Invest cryptocurrency in various projects

Many different companies and startups attract investments, and some of them are in the sphere of cryptocurrency. Thanks to the widespread use of cryptocurrencies, any company in the world can attract investments in cryptocurrency and sell a share without unnecessary bureaucratic procedures, which usually take a lot of time. However, thanks to block-chain technology and the fact that anyone can see a transaction and verify it – anything is possible. Basically, this way investments are attracted by technology startups and projects directly related to cryptocurrencies.

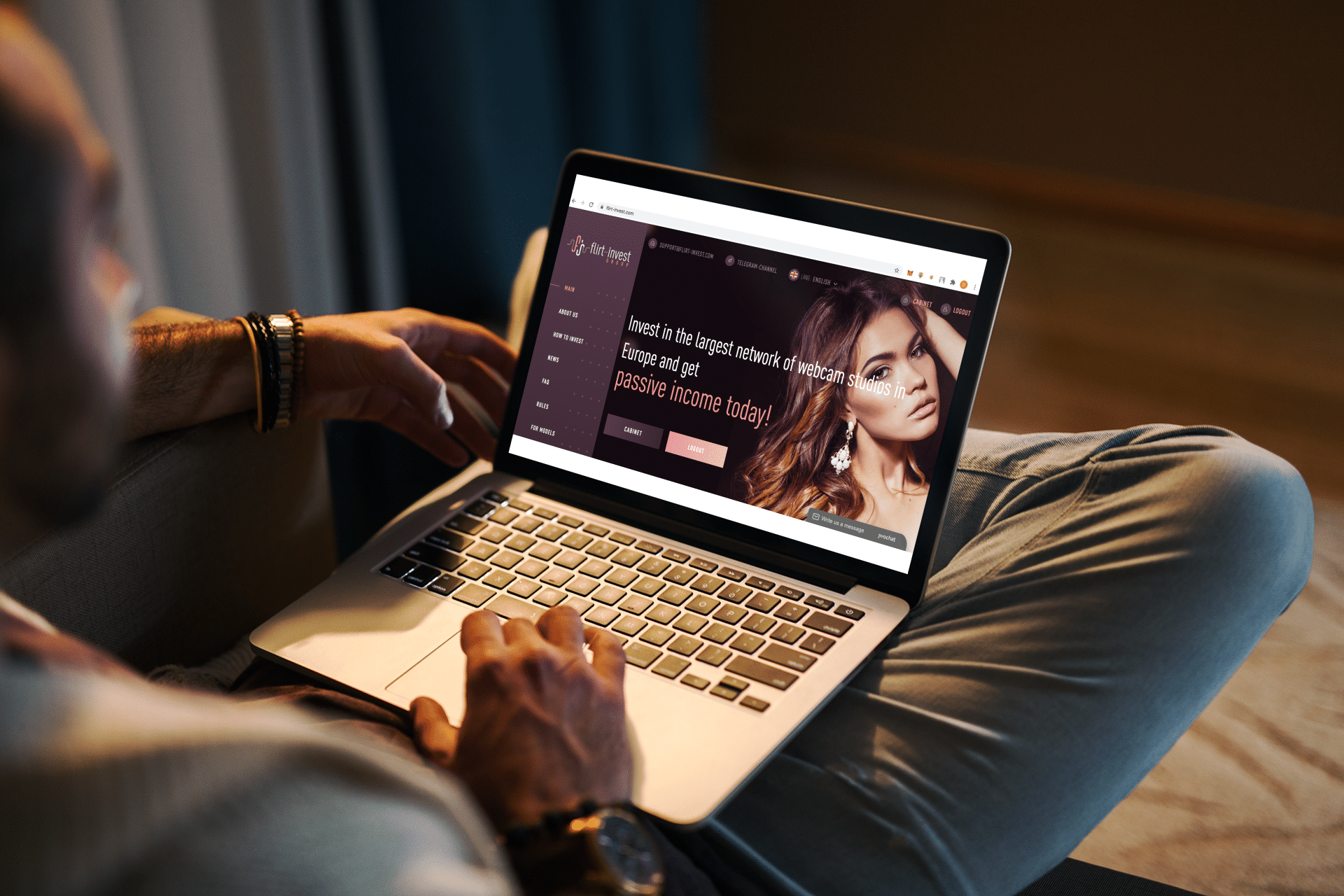

However, there is a variety of projects and companies that, for different reasons, cannot go to the IPO and publicly place their shares, so they resort to cryptocurrencies. For example, Flirt Invest is a project attracting funds to the largest network of webcam studios in Europe. Obviously, they cannot go to an IPO and place their shares, since webcams is an activity, which is not legalised everywhere.

Flirt Invest raises funds in the form of cryptocurrencies with daily dividend payments to investors with a profit of 15% monthly! For traditional markets, this is a fair amount of money. It allows the company to attract investments from anyone, while the webcam sites themselves, pay money to the models in cryptocurrency as well, so the company directly pays part of the earnings to investors and avoids huge bank fees and difficulties in international transactions.

We are sure that cryptocurrencies have a bright future, and now there are many ways to earn money thanks to them. There will be even more crypto-opportunities as years go by!

The last but not least piece of advice to keep in mind: don’t invest all your money in one project – diversify your portfolio!

Related posts:

Source: Read Full Article