Somewhat of a paradox with bitcoin’s use cases is that as demand grows, certain aspects of it perform worse and worse; something that can happen even when the price rising. An apparent price rally lead bitcoin prices above previous all time highs, for it to keep trading above $2000 levels. Many vital parts of the bitcoin economy benefit greatly from this increase in bitcoin’s price.

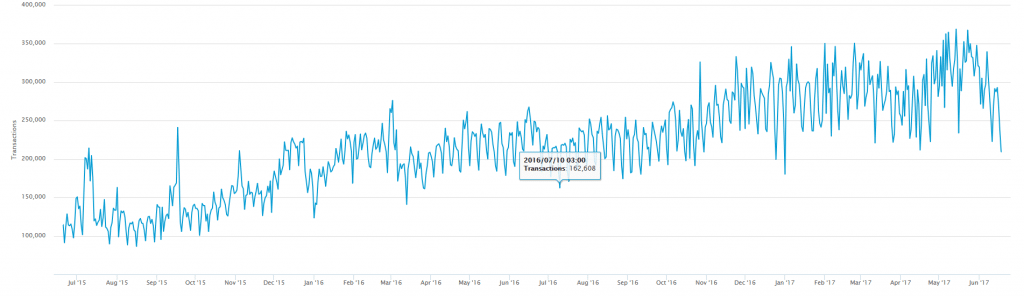

To name a few, pools are seeing an automatic increase in their earnings as the commissions they stably get from miners increases in value along with the price, mining becomes more profitable, exchanges experience greater trading volumes as speculation becomes more rampant and services receiving fees in bitcoin see their revenues also rise.

The bullish spiral cryptocurrency economies can enter with a price increase is unfolding right in front of our eyes. With bitcoin’s price increase essentially kickstarting a market-wise bullish overturn, cryptocurrency traders managed to make the markets of several other cryptos explode along with bitcoin’s.

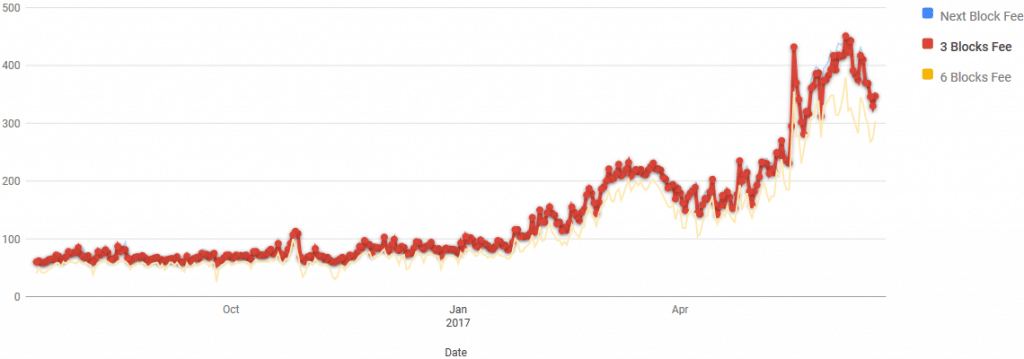

It’s evident that bitcoin has proven itself to be great as a speculative tool, and hence a valuable commodity for risk takers and traders after great returns. Many people have dubbed bitcoin as the best performing currency and recent events can only serve as proof that bitcoin is indeed achieving great performance in terms of returns. But really, how comparable can bitcoin be to currency at its current state?

In reality, bitcoin’s success as a commodity is (at least to some extent) incompatible with its success as a currency. In order better understand the reason behind this paradox, one would need to look in the metrics that make something a successful currency or commodity. For commodities, success is measured in its returns against the rate of return of a relatively low risk asset. This way, as the price goes up, holders of said commodity benefit.

As of currencies however, the metrics measuring success are quite different. One would argue that usage of a currency dictates its success, but for people to use something as currency, people would need to have a sense of safety. For example, the success of the dollar as a currency is not measured in how much it trades for against the euro, but rather what users can buy with it, how many markets are open to them.

Source: Read Full Article