Over the last few years, we’ve seen a strong trend towards governments either bringing in regulations surrounding digital currencies or outright banning them. While places like the European Union have taken the regulatory approach, others, such as China, have taken the latter.

A report by the Library of Congress shows that the number of countries that have banned digital currencies has doubled in three years. Nine of them have outright banned digital currencies, and 42 have an implicit ban.

What does the Library of Congress report show?

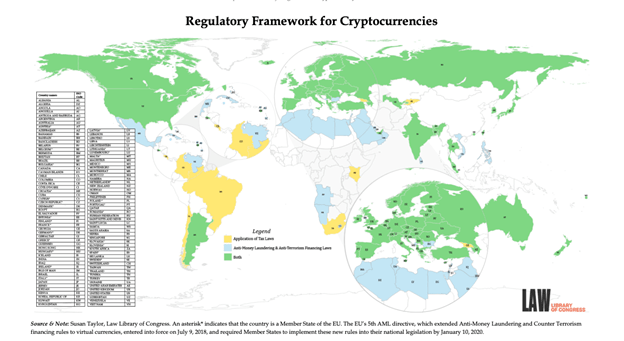

The report looked in detail at the regulation of digital currencies around the world. It considered whether countries had either an absolute or implicit ban, whether they taxed digital currencies, and whether they applied AML/CFT laws to them.

- With regards to bans, the report found that nine jurisdictions have outright banned digital currencies. These include Algeria, Bangladesh, China, Egypt, Iraq, Morocco, Nepal, Qatar, and Tunisia.

- A further 49 jurisdictions have explicitly banned digital currencies. Without listing all of them, this list includes Bahrain, Georgia, Indonesia, Kazakhstan, Lebanon, Macao, Nigeria, Pakistan, Saudi Arabia, Turkey, the UAE, and Vietnam.

- Most major countries in economic terms apply AML/CFT laws to digital currencies, and an increasing number of them tax all digital assets. Those who don’t will almost certainly do so in the next few years.

One of the key takeaways from the report is that the number of countries that have banned digital currencies has doubled in three years. In 2018, when the report was first published, eight countries had banned digital currencies, and only 15 had implicitly banned them.

What is the difference between an absolute ban and an implicit ban? In the context of this report, an absolute ban means that transacting or holding digital currencies is a criminal act. On the other hand, an implicit ban means that exchanges, banks, and other financial institutions are prohibited from dealing in or offering services related to digital currencies.

What does this mean for the future of digital currencies?

At CoinGeek, we’ve been screaming from the rooftops for years that this industry is built on pillars of sand. For all the talk that everything is decentralized and beyond the reach of governments, the reality is, governments have shown that they can end it all with the stroke of a pen. As this report and others show, they can make it impossible for exchanges to operate legally and block digital currencies from their financial systems, effectively neutering the industry in their jurisdictions.

Why is the number of countries banning digital currencies growing so rapidly? While the indoctrinated maxis will interpret this as fear and government attempting to block innovation and maintain control, the truth is that almost all digital currencies are worthless scams that deliver no real innovation or fundamental value to anyone. As the total market cap of the industry grows, it poses an ever-greater risk to financial stability in many countries.

However, financial stability is only one-half of the equation. The other is the sheer amount of crime and corruption involved. Scam after scam and hack after hack empty the pockets of retail speculators, and truth be told, many countries can’t afford for even a small percentage of their citizens to lose some of their savings to these scams. Add in that the industry turns a blind eye to obvious frauds like Tether, and that some industry players seem to revel in and even glorify the lawlessness of it all, it’s little wonder that an increasing number of governments are deciding they want no part of this so-called revolution in finance.

Can we expect this trend to continue? Absolutely, but the real metric to keep an eye on is the number of countries that regulate digital currencies rather than absolutely or implicitly ban them. While we expect more countries to impose both types of bans in the coming years, the ones that don’t will bring the industry into the line via regulations. The European Union has already made moves in this direction, and we know the U.S. Securities and Exchange Commission (SEC) is going to clamp down hard in the next couple of years.

In the end, this regulation will be good for the industry. It will squeeze the rogue actors out of it and give legitimate projects that abide by the law a chance to shine.

Perhaps then we’ll see the Library of Congress report show a reversal as countries open up to a truly legitimate, innovative industry in the future? Until then, expect more of the same.

Watch: CoinGeek New York panel, Government & Public Sector Applications on Blockchain

Source: Read Full Article