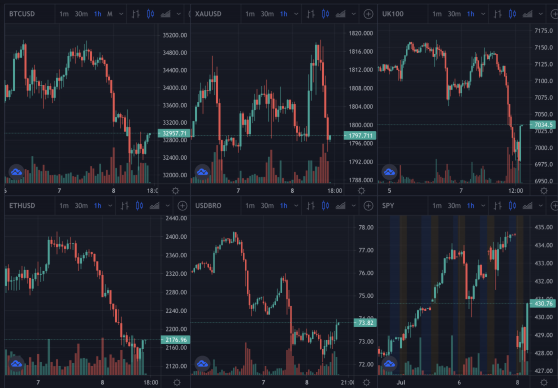

Bitcoin has dropped again today by about 10% at one point from $35,000 to $32,000 with it currently trading at $33,000.

Oil has fallen ostensibly after failure to reach a supply agreement with it down from $76 yesterday to $72 at one point today.

Instead of counteracting, gold is down too from $1818 to $1,798 currently, with global stock indexes down, including S&P 500 (-0.78%) and FTSE 100 (-1.68%) with Dow falling by 0.62%.

This broad market sell off has seen even DXY, the dollar strength index, fall by 0.3% from 92.8 to 92.4.

The only thing up seems to be the euro, gaining against CNY and USD by about 0.5% on the conclusion of a strategic review by the European Central Bank (ECB).

“The new formulation removes any possible ambiguity and resolutely conveys that 2% is not a ceiling,” ECB’s President Christine Lagarde told reporters in a press conference, adding that the strategy review was agreed unanimously. “What we want to do is to avoid the negative deviation that will entrench inflation expectations.”

They happy to let inflation overshoot 2% or undershoot as long as expectations are of a 2% inflation rate in the medium term.

It’s not clear whether this alone is sufficient to explain this small market sell off, with the general lack of liquidity during summer due to the holidays potentially being the main explenation.

The dollar, while it has somewhat strengthened in the short term, it is still kind of sidewaying since October in a zoomed out view, with it unclear whether it has reached a floor.

The euro strengthening is merely due to ECB’s policy being slightly tighter than the Fed’s, but both the dollar and the euro are devaluing with their supply continuing to increase at the rate of hundreds of billions a month.

Thus this general market movement might be more due to the cash on the sidelines taking a holiday instead of investing, rather than a broader trend, but time will tell as it may be the pick up in inflation means a money tightening at some point. So markets might be looking ahead.

Source: Read Full Article