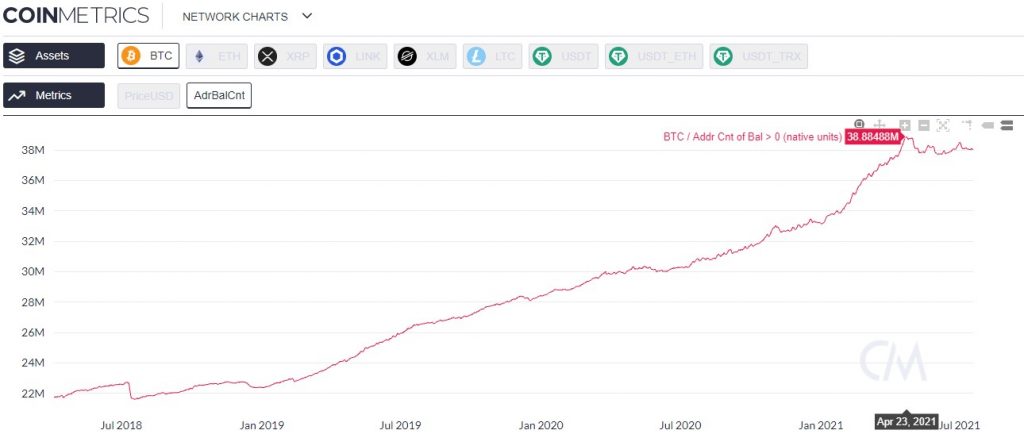

Bitcoin Addresses Peaked at 38.88 Million in Late April

Further investigating Mr. Peterson’s observation by taking a glance at Coinmetrics, reveals that the address growth on the Bitcoin network had been increasing steadily since early 2018 to hit a peak value of 38.88 million in April of this year. The chart below courtesy of the tracking website further demonstrates this fact.

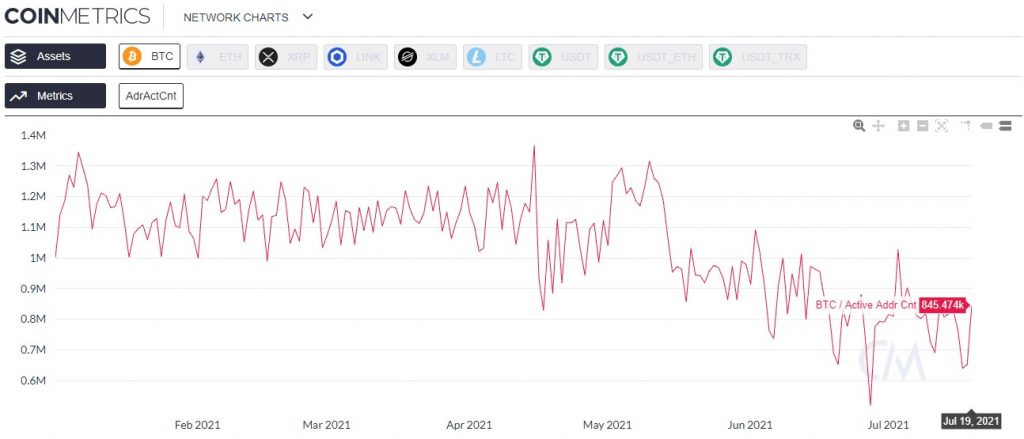

Bitcoin Daily Active Addresses Drops by 38% from April’s Peak Value

Also from Coinmetrics, it can be observed that the Bitcoin network has also experienced a 38% drop in active addresses since the April peak value of 1.366 million. At the time of writing, there are currently 845k daily active addresses on the Bitcoin network as highlighted in the following chart.

Bitcoin Loses $30k Support to Post a Local Low of $29,278

With respect to price action, earlier today, Bitcoin lost the crucial $30k support to post a local low of $29,278 – Binance rate.

Bitcoin losing the $30k support is due to two reasons.

Firstly, the on-chain metrics on the Bitcoin network highlighted above point to a scenario whereby the demand for BTC has dropped thus affecting its value. Secondly, and through technical analysis, Bitcoin is in bear territory as explained by the team at Crypterium analytics through the following statement and accompanying chart.

…the chart continues to move inside the descending channel. Now the price is trying to approach the lower border, and, most likely, it will be able to do it in the near future. Moreover, the bottom line is almost perfectly aligned with the $28,800 mark.

In the event of a breakdown of the $28,800 level, a cascade closing of stop-losses will occur, which will lead to an acceleration of the fall. On this wave, the price can reach the $26,000 level within a few hours. From this area, we can see a bounce back up. But if the market will remain weak and buyers will not be active, then the price can quickly go even lower to the range of $23,000 — $24,000.

Source: Read Full Article