Over 6.42 Million ETH is Currently Staked on the Ethereum 2.0 Deposit Contract

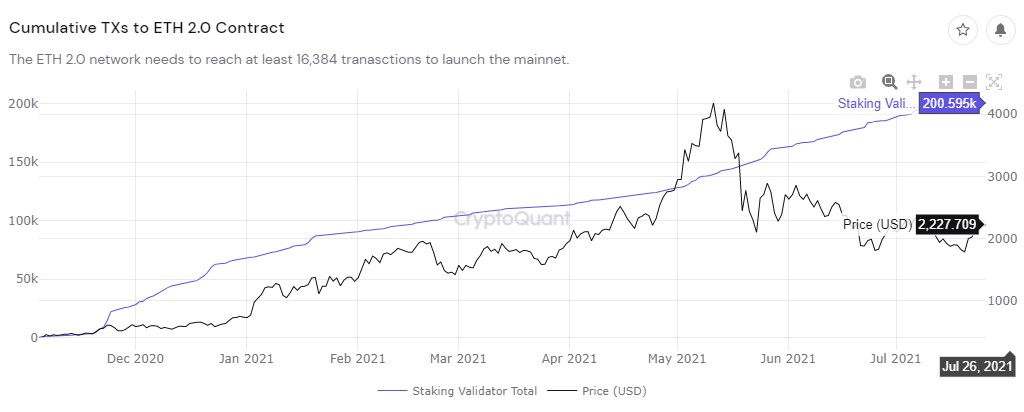

Furthermore, deposits to the Ethereum 2.0 contract continue to increase as the switch to a Proof-of-Stake algorithm, progresses on the network.

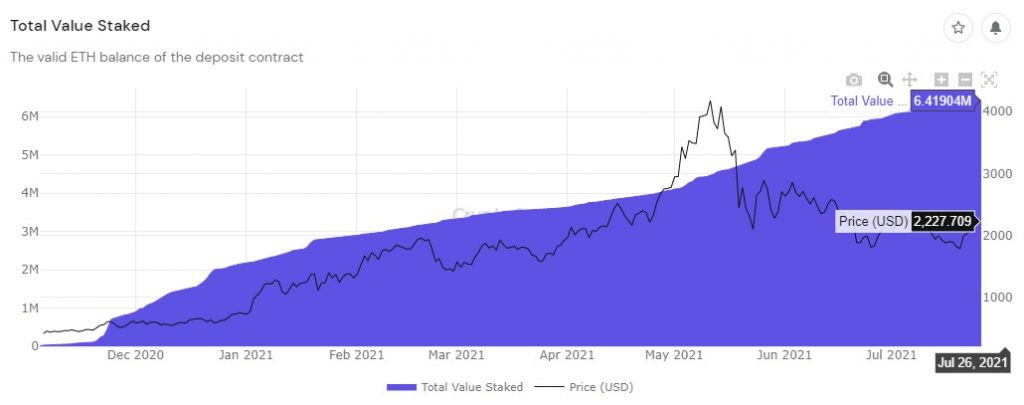

According to Etherescan, there is a total of 6,420,866 Ethereum on the ETH 2.0 deposit contract worth $14.857 Billion. The growth of deposits to the ETH 2.0 contract has been visualized through the following chart courtesy of CryptoQuant.com.

Kraken Is the Single Largest Depositor of ETH to the Ethereum 2.0 Contract

In a similar analysis of the amount of Ethereum validators and deposits to the ETH2.0 contract, the team at Weiss Crypto Ratings pointed out that Kraken is the single largest depositor of ETH as explained in the following statement.

The largest depositor by far is Kraken which stakes 12.5% of all ETH. In fact, exchanges have deposited 24.9%, staking pools 21.8%, and whales 10.1% of all ETH into ETH2.

Ethereum Reclaims the 200-day Moving Average as Support

With respect to price action, Ethereum has benefited positively from Bitcoin’s impressive push to the $40.5k price ceiling earlier this week. The push to $40.5k by Bitcoin resulted in Ethereum hitting a local peak value of $2,433 and thus managing to recapture the crucial 200-day moving average as support.

Ethereum’s impressive rebound in the crypto market has been highlighted in the following ETH/USDT chart.

At the time of writing, Ethereum is trading at the $2,300 price area with its bullish climb most likely to continue due to the following observations from its daily chart.

- Ethereum is in bullish territory, trading above the 50-day moving average and the 200-day moving average

- Trade volume is in the green for the last week

- The daily MACD, MFI and RSI are yet to show exhaustion as investors anticipate the London Upgrade on the 4th of August

- The 100-day moving average (yellow) provides an area of resistance around the $2,500 price area

Source: Read Full Article