The biggest crypto exchange in the world is to start trading on one of the biggest stock exchanges in the world with all eyes now on this event.

Futures have it at about $600 per share, giving it a market cap of $150 billion, more than any other exchange, including Nasdaq where it will be listed or NYSE.

“Based on valuations in European private markets, Coinbase was trading at a $150bn valuation this morning (higher than the LSEG, ICE and CME market cap combined), and at close to 60 price to sales ratio, while other exchanges trade between 3 (Nasdaq) to 15 (CME).

This is further proof that the framework of traditional valuations is broken,” says Amber Ghaddar, Co-founder of AllianceBlock, described as the first globally compliant decentralized capital market.

Tesla has traded at a P/E of more than 1,000, while GME has long traversed beyond the P/E valuation method, with some ascribing the phenomena to the opening of stock trading to more of the public through apps like Robinhood.

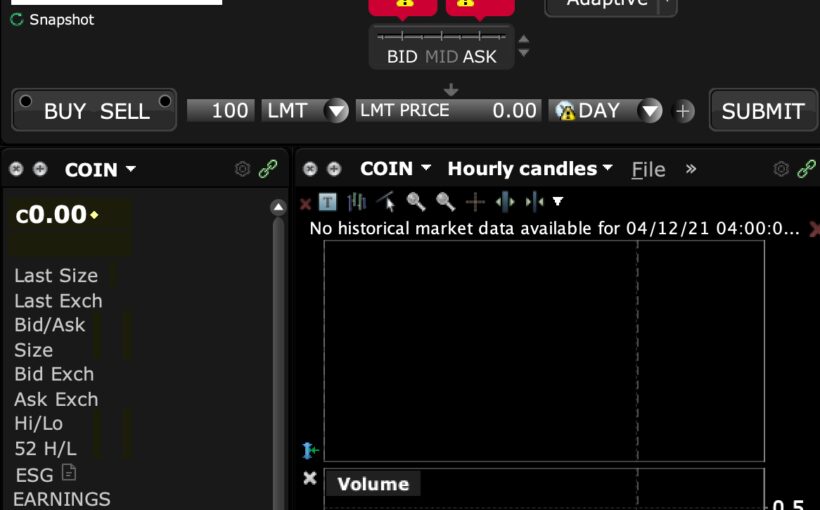

On the first day of trading moreover volatility is to be expected, with Jun Li, founder of Ontology, stating the Coinbase listing “signifies the acceptance of cryptocurrency business in traditional finance and will bring in even more funding and investment from a range of different institutional investors, but it will also attract new talent to the industry with broader skill sets.”

Bitcoin has been rising in the past few days, up 10% this week to $64,000. How the coin will react once Coinbase trading starts, however, is not clear.

Some suggest it may indirectly open more access to the crypto market with Eric Kapfhammer, COO and Head of Polyient Capital, stating:

“The Coinbase NASDAQ listing is essentially the first legitimate bridge between the traditional capital markets and the crypto markets. My estimate is that, once established, we will surely begin to see more flow of capital into crypto-focused companies and cryptocurrencies themselves.”

There are numerous bitcoin miners already trading on stock markets, but this is the first established crypto exchange of size to list and that will bring legitimacy, says Greg Carson, Head of Corporate Development & Venture Capital at Stablehouse:

“Going public is a great validator for any emerging industry. The trend has been clear throughout the history of emerging technology — computers (Apple), mobile phone companies (Sprint), software companies (Microsoft), and internet companies (Amazon, Google) all had periods where the financial community and public were sceptical.

Going public in the face of this scepticism is a bellwether event, leading to acceptance from traditional spaces and transformation of their industries over time.”

With bitcoin now nearing the market cap of silver, it is becoming an unignorable asset. This listing of Coinbase thus is in many ways its debut as the crypto is about to enter mainstream finance.

Source: Read Full Article