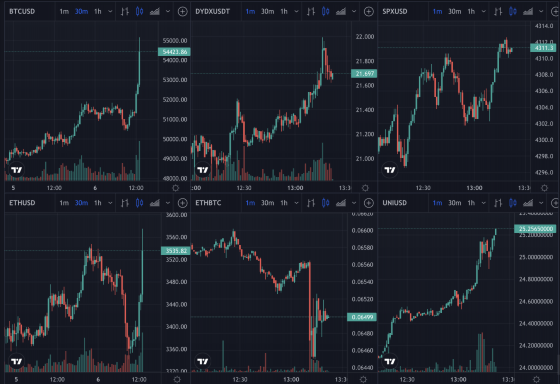

Bitcoin has smashed through to nearly touching $55,000, up $5k in minutes with it currently trading at $54,500.

The jump coincided with the opening of the stock market which for today happens to be a bit down again, with Dow Jones at 0.5% in red.

This display may start cementing a change in bitcoin’s behavior to a safe haven asset of sorts, at least temporarily, as for the entire week it has risen while stocks have fallen.

Ethereum has also risen to it now near $3,600, but it’s ratio is down to 0.066 BTC from above 0.07, that’s a difference of circa $1,500, but ethereum usually follows.

Why is it lagging? The first explanation is that eth had been rising while bitcoin was lagging. The NFT boom, the burnening, the rising stake, the expanding defi and its airdrops all contributed to a fairly fast gain in ratio for eth as it led the show.

Now it’s bitcoin’s turn in this continued ping pong, with the lion seemingly awoken as it nears its 13th birthday on this halloween when its whitepaper was published in 2008.

Just as other teenagers, bitcoin too doesn’t quite know what it wants to do. Is it money, is it a commodity, is it a speculative investment, is it a revolution, or is it just an idiot as some grandpas say, a jihadi jesus fin christ.

Except for the grandpa nonsense, it’s probably all of it and it has not even taken its final form yet with the current corporate media explanation being that maybe a bitcoin ETF approval is what’s doing it.

That’s probably a small part, with an even smaller one being GeeGee GiGi or GG, or SEC Chair Gary Gensler saying he ain’t gone ban it.

Lmaos are rarely allowed in these pages, but godking Jay Powell saying something similar could have assured grandpas, some of whom have said gov just gone ban the lion coin.

Some less informed may have well been concerned that FED could also impose a China style banking blockade on crypto, but the independence of the judiciary would first have to die for that in the land of the free, and if that happened we would have far bigger problems than having fun on crypto waves.

You could say that some bank holding corn deposits could also be a contributor. Except this isn’t quite 2013 when we were trying to figure out how to really secure keys. Chop it up and put it in your shoes right.

The fundamental reason is probably troubles in China narratively and the whole fiat system kind of changing. We were puzzled a few weeks ago when bitcoin seemed to just be following stocks while all that property crisis was and still is going on.

As it happens, we may have guessed right. It was just a temporary speculative play by boomer traders with that unable to hold for long because bitcoin’s fixed limit eventually kicks in raw supply and demand forces, with demand logically rising if there’s even a whiff of banking concerns.

Bitcoin acting as stocks was always unnatural because bitcoin is the goods itself, while stocks are an abstract and artificial creation that tries to reflect the performance of goods but if you buy an apple phone, that doesn’t necessarily have to reflect on Apple stocks. While if you buy a bitcoin because you want to send it to your parents in El Salvador, then your action is directly reflected on price.

The background mystery on why bitcoin is rising however may be a deeper theory on the nature of money itself and the very unappreciated effects of supply and demand that seem to have a far too outsized impact than plain -50% supply means +50% price as taught in the textbooks of economics.

That may partly be because block rewards are locked for three months, with bitcoin delaying the effects of a changeperhaps to give a feeling that nothing has changed.

That gradual change in feeling however eventually manifests itself, but it does seem a bit artificial to suggest that all the narrations are more decorations to the halvening forces.

That’s because the experiment is not isolated but integrated with there naturally being factors that affect demand. The halvening thus is maybe more a multiplier or amplifier where small positive changes in demand translate to outsized action.

One such perhaps very small change in demand is the suggestion that stablecoins are banks. GeeGee subpoenaed Circle, with the real reason probably being that the government wants control over dollar tokens.

The question is obviously what responsibilities would come with such privilege. Powell seems to have heeded us in that it is a bit too soon to regulate as it probably would be better to give some space for more competition to rise and for the whole thing to mature a bit. Once the thing gets to perhaps a systemic size, maybe a market cap of $1 trillion for all stables, then Powell, the public, and Congress will have to grapple with whether such coins should be guaranteed by the Fed.

However it is starting to become mainstream a certain view that some sort of decay or incompetence is festering in the US government in particular with some suggesting it is because of far too much groupthink in a bubble of same bureaucrats where new thinking, new ideas, let alone ambition or vision, are pretty much non-existent.

The United States can’t afford that for much longer because when meritocracy dies, the system collapses. So you’d hope some able millennials in the bureaucracy will try and make some changes to make the system more agile and more responsive as well as more adaptable to change.

For now we have to deal with what is and as far as we’re concerned, they can even ban all the stablecoins if they want to because that would mean all that value would go into bitcoin and cryptos which would be used more as money and so put a higher floor on price.

If instead they want to regulate them, it has to been done properly, by a proper agency, under a proper authority and mandate, in a way that doesn’t put the civil service up for blame when it rains.

The reason we don’t do law by enforcement, for example, is that each case will be unique to the facts of the matter and there will necessarily be winners and losers in who are picked for enforcement.

Is something like Circle a bank for example? A bank takes deposits from the public, and then has the privilege of outright printing money through lending. For that privilege, the barriers to entry are arguably too high even with the right to print.

Something like Circle or a USDc function is far more limited in that first of all there is no right to print. In theory, someone like GG could say they ‘print’ when they issue tokens backed by say bonds rather than fiat. That however is still different than outright printing through loans.

The Office of the Comptroller of the Currency (OCC) therefore moved to issue a Fintech charter for more limited monetary activities that still contain some level of trust, like USDc where the ‘converter’ is in a fiduciary position, so for such centralized stables there probably will have to be eventually you’d think a government guarantee which thus means regulations.

That Fintech charter however has been clogged up in courts with that whole ‘finance but not banks’ industry sort of in limbo as established banks maneuver to delay or slow down disruption.

As it happens Biden seems to be an anti-innovation president, so GeeGee seems to be taking advantage of the slow moving proper legal system to engage in effectively witchery.

Banks are exempt from SEC authority with the Securities Act 1933 exempting them from all the restrictions in regards to investment prohibitions or fundraisings.

Back in 1933, there was no Fintech, so Congress did not consider whether to exempt them. Yet technically by the law, if not exempt then GeeGee. However, where the spirit of the law is concerned, these are both banks and are not banks so it is for Congress to decide whether SEC has authority over them or OCC or some Fintech regulator.

GeeGee has said as much, but presumably he doesn’t expect to stay as chair long so he’s doing his best to reveal that incompetence at the bureaucracy.

That gives an opening to Europe and London which itself has to consider whether euro tokens or pounds that has a centralized custodian or ‘converter’ should be gov guaranteed up to a certain amount like bank deposits or otherwise and how they should be regulated to try and address that position of trust of the converter.

Where this space is concerned, we have all the DAI and the sEUR or nowadays even cCHF and all them other algorithmic stables which don’t quite need trust and thus don’t need regulation because there isn’t a position that can abuse such trust.

The only reasonable regulations you can have there is ‘ensure the code doesn’t have bugs,’ but that’s a bit impossible and the only way we’ve found how to reach the maximum level of ensurance is to start small and see if anyone takes the ‘bounty’ of ‘deposited’ funds in the smart contract.

Overall however where cryptos are concerned these are good ‘problems’ to have because it gives us an opportunity to update the laws and make them more fit for a digital age, as well as makes crypto more comfortable for grandma where centralized entities are concerned.

Where decentralized entities are concerned, they replace a huge chunk of trust or fiduciary positions which is the whole base of all these laws and regulations, so if there should be any regulations at all and what sort can only be accepted after a legitimate process through Congress or other law making bodies in line with national constitutions.

In its absence, there’s far too much at stake for one bureaucrat or one bureaucratic entity to determine the shape or direction of the entire global economy with any such claim probably not recognized by coders.

So it’s all actually good news for bitcoin with it to be seen now just how much that Austrian school of economics still has to teach us as bitcoin hits a new high in five months.

Source: Read Full Article