Shares in Endeavor Group Holdings will begin trading Thursday at $24 a share, realizing a longtime plan to take the company public.

The owner of WME, IMG and mixed-martial-arts circuit UFC is also planning to take full control of the UFC in a transaction that is separate from the IPO.

The price is at the top end of the range for the offering, which succeeds a previous IPO attempt in 2019, which was yanked at the 11th hour. Unsettled market conditions and tensions with the Writers Guild of America over packaging undid the effort two years ago, but WME and other agencies since reached an accord with the WGA. A revised prospectus last week pegged the range at $23 to $24 a share.

Updating its plans this evening in a registration statement, Endeavor said it is offering 21.3 million shares of Class A common stock, plus up to nearly 3.2 million shares of Class A common stock that the underwriters have a 30-day option to purchase.

When trading starts Thursday on the New York Stock Exchange, Endeavor shares will trade under the symbol EDR. The offering is expected to close on May 3.

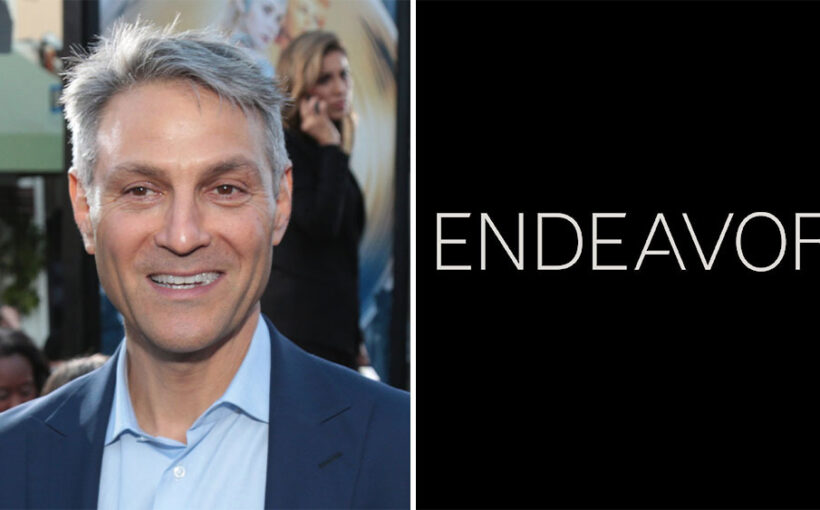

CEO Ari Emanuel and executive chairman Patrick Whitesell will have a controlling interest in at least $900 million worth of stock combined if the offering goes as planned. The IPO values Endeavor at about $10 billion.

Silver Lake will be the biggest stakeholder in Endeavor, which has made a series of aggressive acquisitions in recent years to branch out from its agency roots. While it continues to be a talent rep powerhouse, the company also owns streaming tech, fashion, production, sports and data analysis assets.

Separately from the IPO, a private placement has been arranged that will yield $835.7 million for Endeavor to take full control of UFC. An additional $951.5 million is designated as working capital.

Endeavor led a group of private investors in a $4 billion acquisition of the UFC in 2016. While the circuit has grown steadily, especially among younger fans, and netted lucrative TV and pay-per-view deals, the transaction added to Endeavor’s debt load.

Last week’s filing put the company’s debt at a hefty $5.92 billion on a pro forma basis (as of December 2020, assuming the IPO and UFC transactions are completed). Cash and cash equivalents were $1.96 billion.

Morgan Stanley, Goldman Sachs, J.P. Morgan and Deutsche Bank are joint lead bookrunners. Barclays, Citigroup, Credit Suisse, Evercore ISI, HSBC, Jefferies, Moelis & Company, Piper Sandler & Co., RBC Capital Markets and UBS are joint bookrunners. CODE Advisors, DBO Partners, LionTree, Academy Securities, R. Seelaus & Co., Samuel A. Ramirez & Company and Siebert Williams Shank are co-managers for the proposed offering.

Read More About:

Source: Read Full Article