The New Zealand sharemarket was a little edgy and fell nearly 1 per cent as it awaited Friday’s unique exchange traded funds activity in the leading energy stocks, Contact and Meridian.

The S&P/NZX 50 Index closed at 12,636.55, down 114.83 points or 0.9 per cent on solid volume of 64.6 million share transactions worth $219.62 million. The index fell from an early morning burst that reached 12,770.83 points.

There were 57 gainers and 81 decliners over the whole market of 185 stocks.

Nigel Scott, investment adviser with Craigs Investment Partners, said trading was choppy. People are waiting for the Contact and Meridian event, which is a rare thing for the market.

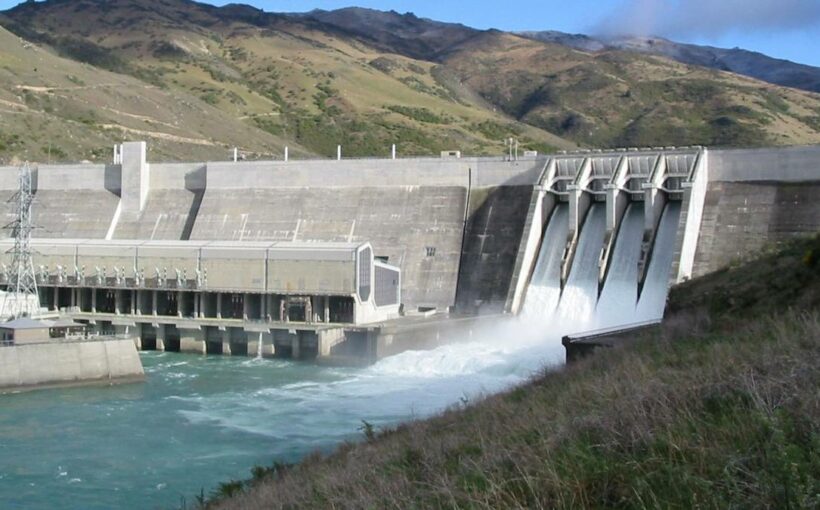

After the end of trading Friday, the two iShares Global Clean Energy exchange traded funds (ETFS) will be closing out dealings to rebalance their weightings in Contact and Meridian. Up to $1 billion worth of shares – representing 5 per cent of each stock – could be traded.

“People have been buying Contact and Meridian in anticipation and their prices have gone up – but it feels like the market has been caught short. I’m wondering if the ETFS wanted to get higher prices,” Scott said.

After some steady rises over the past two weeks, Contact and Meridian did fall – 11c to $7.50, and 5c to $6 respectively. There was again heavy trading in the stocks, $43.24m worth of Contact shares and $29.1m worth of Meridian’s. This strong trading has been happening all week and the market is wondering how much this is attributable to the ETFS. It will soon find out.

Other energy stocks Mercury fell 15c or 2.19 per cent to $6.70, and Genesis was down 11c or 3.17 per cent to $3.36.

The rebounding Fisher and Paykel Healthcare was down 64c or 1.92 per cent to $32.69; Auckland International Airport declined 20c or 2.6 per cent to $7.50; SkyCity Entertainment lost 6c or 1.73 per cent to $3.41; Napier Port also shed 6c or 1.71 per cent to $3.45; AFT Pharmaceuticals fell 7c to $4.17; and Sky Network Television was down 0.004 or 2.17 per cent to 18c.

Port of Tauranga rose 12c or 1.62 per cent to $7.55; Ebos Group was up 10c to $29.95; Turners Automotive climbed 10c or 2.86 per cent to $3.60; insurer Tower increased 3c or 3.66 per cent to 85c; and The New Zealand Refining Company gained 2.5c or 5.05 per cent to 52c.

The Fonterra Shareholders’ Fund rose 12c or 2.68 per cent to $4.59 after dairy farmers fixed their new milk supply agreements.

Chorus, down 12c or 1.83 per cent to $6.42 and hampered by a regulatory reset, reported that its total fixed-line connections fell 13,000 to 1.356m for the third quarter. Copper broadband and voice connections declined by 42,000, similar to the previous corresponding period, and fibre broadband connections increased by 29,000, compared with 32,000 for the same period last year.

Dual-listed Michael Hill International rose 6c or 7.23 per cent to 89c after reporting an increase in sales for the third quarter ending March. Same store jewellery sales across its New Zealand, Australia and Canada markets were up 16.4 per cent compared with the previous corresponding period. Online increased more than 69 per cent and now represents 5.6 per cent of total sales, up from 2.9 per cent for the same period last year.

Oceania Healthcare announced its $50m retail offer at $1.2796 a share was oversubscribed, with 5000 shareholders making applications. Oceania’s share price slipped 3c or 2.24 per cent to $1.31.

Mark Verbiest is taking over as chairman of Summerset Group Holdings to replace Rob Campbell who is retiring after 10 years. Verbiest is also chairman of Meridian Energy and Freightways and a director of ANZ Bank.

Summerset’s share price fell 4c to $11.99, fellow retirement village operators Ryman Healthcare was down 21c to $14.65; while Arvida rose 4c or 2.27 per cent to $1.80 on the back of a broker’s upgrade.

Trading in Tilt Renewables shares was halted after the wind farm specialist told the market it was considering what may be a better takeover deal than the $3b offer made last month by Mercury Energy and Powering Australian Renewables. The early offer was valued at $7.80 a share and Tilt’s price was $7.60 when it went into a trading halt.

Source: Read Full Article