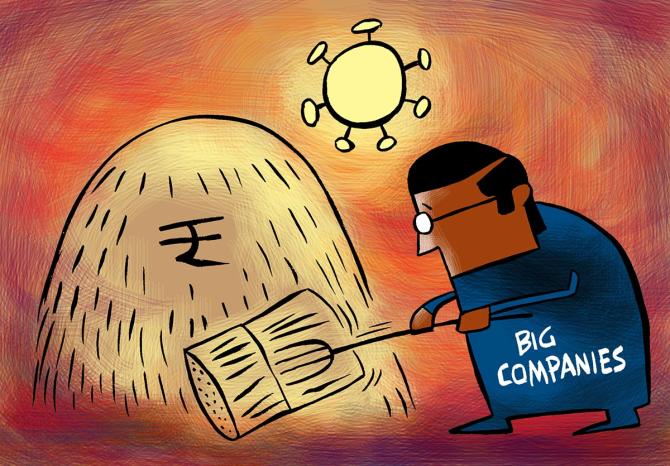

The Ministry of Corporate Affairs (MCA) is considering a regulatory framework for large unlisted companies that may have systemic implications, a top government official said.

The ministry is of the opinion that there is a need for a rigorous regime for large unlisted companies, in contrast with the current “light-touch” regulation.

“There is a defined regime for listed companies, by the Securities and Exchange Board of India (Sebi).

“There is a view in the ministry that it needs to look at a framework for large unlisted companies,” the senior official said.

These regulations are expected to be part of deliberations of the Company Law Committee, the senior official added.

The tenure of this committee was recently extended by a year until September 16, 2024.

“We are mindful that smaller companies should have low compliance burden, but there are several unlisted companies that are relatively large and can have implications on the overall ecosystem,” the senior official said.

The Companies (Amendment) Act, 2020, provided for the preparation of financial results of prescribed classes of unlisted companies periodically, but the same was not notified by the MCA.

While discussions on what should be the criteria to define large unlisted companies have been ongoing, the issue has gained significance amid recent suspected incidents of corporate governance lapses in startups, including edtech major Byju’s.

The MCA a few months ago ordered an inspection of Byju’s books, following reports of the resignation of its auditor Deloitte Haskins & Sells and three of the company’s board members.

The Companies Amendment Bill is currently going through inter-ministerial consultations.

The ministry is keen to introduce the Bill in the Winter session of Parliament.

The Company Law Committee has suggested several changes to the existing law, including more exhaustive norms for the resignation of auditors.

The senior official quoted above said that the government would study whether some of these recommendations could be incorporated via changes in regulations, without changing the law.

Borrowing the provisions from the UK Company Act 2006, the committee recommended: “The auditor shall be under an explicit obligation to make detailed disclosures before resignation and should specifically mention whether such resignation is due to non-cooperation from the auditee company, fraud or severe non-compliance, or diversion of funds.”

The committee chaired by secretary, MCA, will deliberate on further changes that need to be made to the company law.

The committee was formed as part of the government’s objective of promoting ease of living in the country by providing ease of doing business to law-abiding corporations, fostering improved corporate compliance for stakeholders at large, and addressing emerging issues having an impact on the working of companies in the country.

Source: Read Full Article