Globally, investors are becoming increasingly concerned about inflation, which has cast a pall on once high-flying equity and debt markets. China’s outlook appears mixed as the credit growth slowdown has impacted pockets of the economy, whilst corporate defaults are uncomfortably high. As for the rest of Asia, many countries may see their economic recoveries cut short by a new wave of Covid-19 infections, given slow vaccine roll-out in many places.

The global outlook is highly uncertain on many fronts, creating a conundrum for investors since both bond and equity values may be at risk in the short term. For example, should inflation continue to edge higher as predicted by many analysts, corporate earnings could be hit by rising costs, depressing stock valuations, while bond values may fall as investors demand higher returns. U.S. Federal Reserve guidance towards inflation expectations remains the near-term risk for markets.

Consider non-traditional asset classes

To help resolve the dilemma of a low-yielding environment, income-seeking investors should start looking at non-traditional asset classes that can potentially generate higher income.

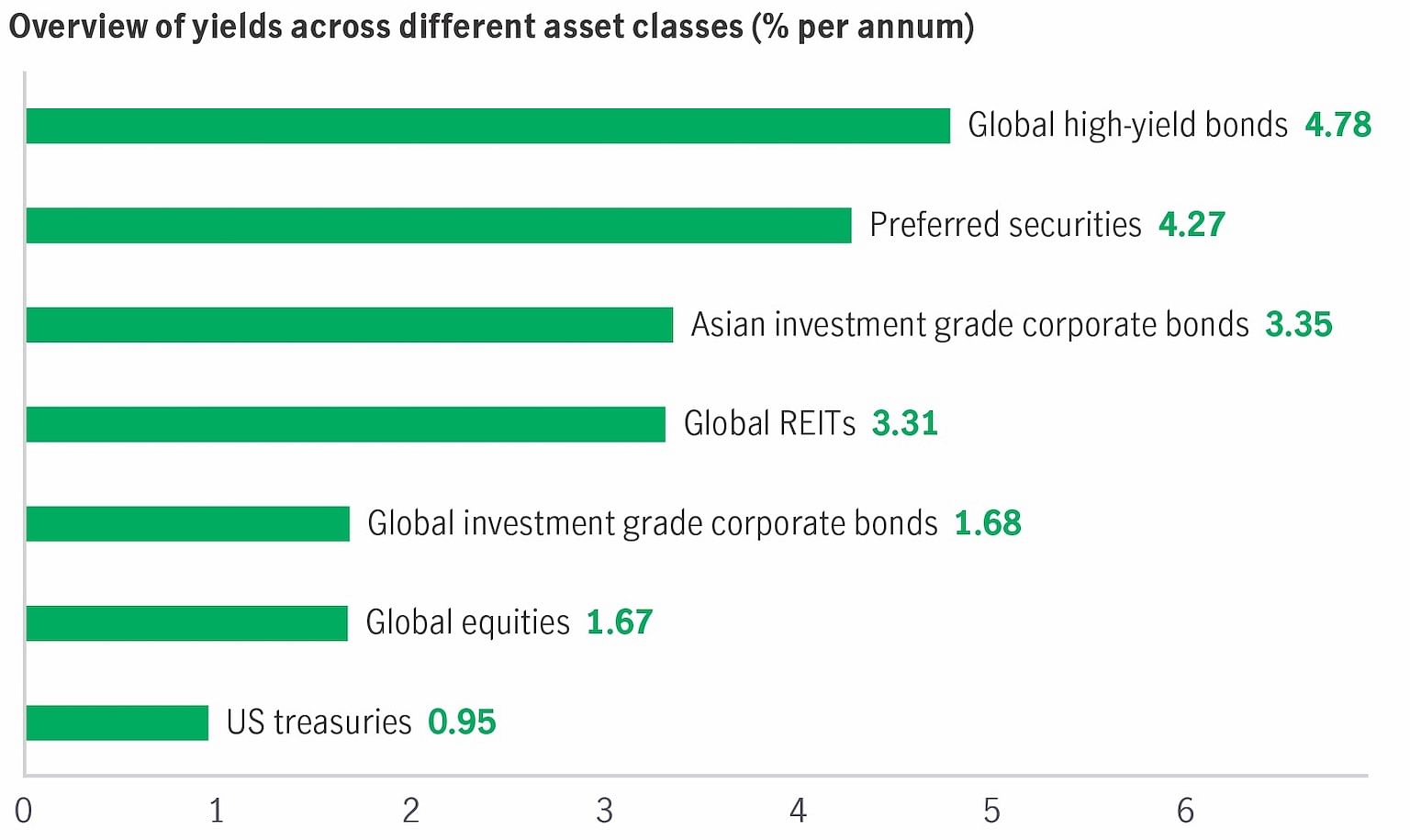

As seen from the table below, assets such as preferred securities and real estate investment trusts (REITs) offered better yields compared to U.S. government bonds and higher quality corporate bonds. Such investments also have moderately low correlation to investment-grade bonds, providing greater diversification to portfolios that comprise mostly stocks and bonds.

While income investments may lag global equities in delivering returns (which includes yield and capital appreciation) over the long term1, they add diversification to one’s portfolio and also offer alternative sources of income when markets are down.

Preferred securities

Preferred securities are hybrid instruments with features found in bonds and equities. Like bonds, preferred securities provide holders with recurring income at rates that had been fixed at the time of issue. Preferred securities are usually rated by external credit rating agencies, giving holders an extra level of oversight.

Preferred securities may, however, be structured such that companies can defer payment without triggering a default, making them similar to regular stocks. Examples of preferred securities include preference shares, perpetual securities and junior subordinated debt.

Investors in preferred securities rank above equity, and below senior bond holders, for payments, should the company default on its obligations.

REITs

REITs invest in properties and are required to pay out most of the rental income to shareholders once mortgage payments and other costs are accounted for. REITs are also subject to tighter regulation compared to other property firms, and there are caps on how much REITs can borrow, for example. The rules, however, vary from country to country.

Unlike the interest payment on bonds, the dividends or distributions paid out by REITs are not guaranteed and may fall if rents weaken or if the cost of servicing their loans increases. The dividend payments may increase if leases are renewed at higher levels, which is why REITs tend to be regarded as a form of equity.

Using options strategy to generate income

Fund managers can also generate income by writing and selling options to lock in some returns while managing the volatility of equity investments.

One example of how a fund manager can use options to generate income is to sell another investor the right, but not the obligation, to buy a share currently worth $10 for $11 anytime over the next 12 months. The fund manager earns a fee from selling the option but any potential gain from holding the share is capped at $11, since the other party will exercise the option if the price exceeds this level.

Invest in non-traditional assets through Manulife Investment Management

Manulife Global Fund – Preferred Securities Income Fund

The Manulife Global Fund – Preferred Securities Income Fund aims to provide investors with regular income along with potential long-term capital appreciation by investing primarily in preferred securities.

As of April 30, 2021, the fund held 82 different securities with an average investment-grade credit rating of BBB- and a yield to maturity of 4.83 per cent. About 70 per cent of the fund is invested in securities issued by utility providers, insurance companies, and banks, all of which tend to be highly regulated with stable cash flows.

The fund returned 17.80 per cent in SGD terms in the 12-month period to April this year. For the period since the fund was incepted in September 2018 to April 30, 2021, the annualised return is 6.30 per cent in SGD terms3.

Manulife Global Fund – Global Multi-Asset Diversified Income Fund

The Manulife Global Fund – Global Multi-Asset Diversified Income Fund generates income by investing in traditional assets such as investment-grade bonds, high-yield corporate bonds, emerging market debt and non-traditional assets such as preferred securities, REITs as well as equity-related covered call and put options.

Part of the fund’s income comes from writing and selling options that allow the fund manager to lock in some returns while managing the volatility of equity investments.

Global high-yield bonds, as the name suggests, refer to bonds with below-investment-grade credit ratings. Such bonds typically offer higher interest payments to compensate investors for the added credit risk.

As of April 30, 2021, the fund held 551 different securities and options. About 55 per cent of the fund is invested in fixed income related securities and cash whilst 45 per cent is invested in equities and equity-related securities.

In the 12-month period to April this year, the fund returned more than 25 per cent in SGD terms. For the period since the fund was incepted in April 2019 to April 31, 2021, the annualised return is 4.67 per cent in SGD terms4.

Don’t put all your eggs in one basket

When times are uncertain, it makes sense to include non-traditional investments to provide greater diversification to your portfolio. The Manulife Global Fund – Preferred Securities Income Fund and Manulife Global Fund – Global Multi-Asset Diversified Income Fund provide that diversity along with an income stream that is potentially higher than what investment-grade bonds can generate.

For more information about Manulife Investment Management’s suite of income funds, please visit income.manulifeam.com.sg.

1Investors should note, though, that past performance does not guarantee future results.

2Global high yield bonds are represented by Bloomberg Barclays Global High Yield Total Return Index; preferred securities by ICE BofA US All Capital Securities Index; Asian investment grade corporate bonds by JPMorgan Asian Investment Grade Corporate Index; global REITs by FTSE EPRA/NAREIT Global REIT TR Index; global investment grade corporate bonds by Bloomberg Barclays Global Aggregate Corporate Total Return Index; global equities by MSCI World Index; US treasuries by ICE BofA US Treasury & Agency Index.

3The Class AA (SGD Hedged) MDIST (G) returned 17.80 per cent (on NAV-to-NAV basis) and 11.91 per cent (on offer-to-bid basis) in the one year to April 30, 2021. Since inception (September 11, 2018 to April 30, 2021), the class returned 6.30 per cent (annualised) on NAV-to-NAV basis and 4.25 per cent (annualised) on offer-to-bid basis, with net income and dividends reinvested.

4 The Class AA (SGD Hedged) MDIST (G) returned 25.07 per cent (on NAV-to-NAV basis) and 18.81 per cent (on offer-to-bid basis) in the one year to April 30, 2021. Since inception (April 25, 2019 to April 30, 2021), the class returned 4.67 per cent (annualised) on NAV-to-NAV basis and 2.04 per cent (annualised) on offer-to-bid basis, with net income and dividends reinvested.

Important information

The source for all opinions and information shown in this article is Manulife Investment Management (Singapore) Pte. Ltd. (Company Registration Number: 200709952G) (“Manulife”), unless otherwise stated. Manulife Global Fund is an investment company registered in the Grand Duchy of Luxembourg. The information provided herein does not constitute financial advice, an offer or recommendation with respect to the funds referred herein. Investments in the funds are not deposits in, guaranteed or insured by Manulife or Manulife Global Fund and involve risks. Distributions are not guaranteed. The value of units in the funds and any income accruing to them may fall or rise. Investors should read the Singapore prospectus, and seek advice from a financial adviser before deciding whether to purchase units in the funds. A copy of the Singapore prospectus and the product highlights sheet can be obtained from Manulife or its distributors. In the event an investor chooses not to seek advice from a financial adviser, he should consider whether the funds are suitable for him. Opinions, forecasts and estimates on the economy, financial markets or economic trends of the markets mentioned are not necessary indicative of the future or likely performance of the funds. Past performance of the funds is not necessary indicative of future performance. The funds may use financial derivative instruments for efficient portfolio management and/or hedging. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Join ST’s Telegram channel here and get the latest breaking news delivered to you.

Source: Read Full Article