Coinbase, the largest exchange in the United States, has been the site of several big Bitcoin buy-ins this year.

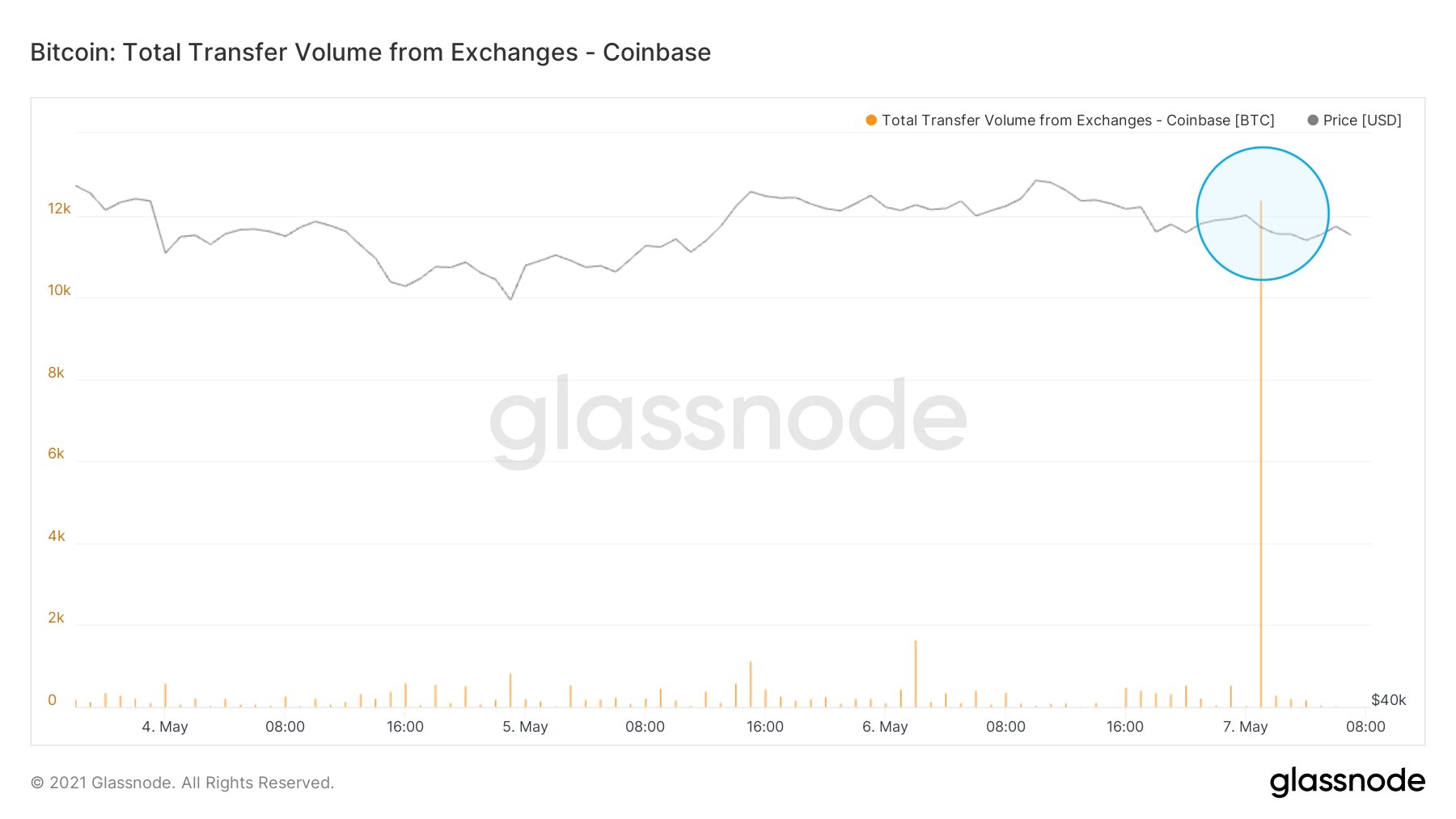

Recent reports show sudden transfers of more than 10,000 BTC to private wallets are not uncommon, but they do show a preference to store Bitcoin for the long term rather than hold it close to a point of sale.

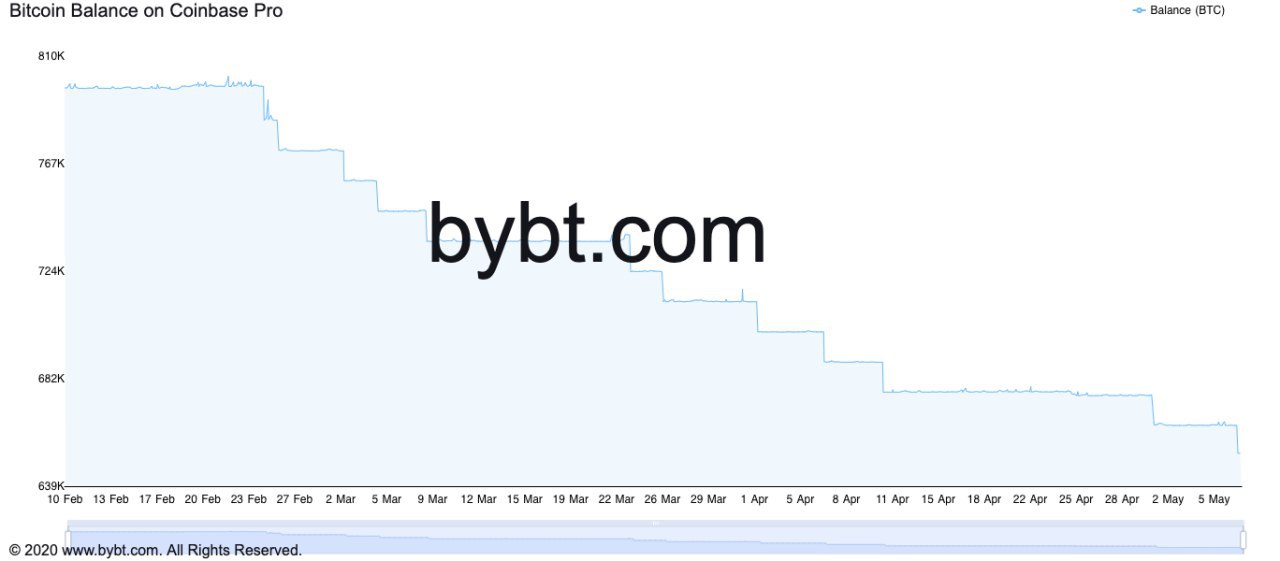

As retail investors face liquidity shortages due to high institutional participation, Bitcoin has been flowing out of Coinbase on a regular basis over the last few months. This is clear, as Bitcoin has outperformed any other institutional asset class in recent years, with returns of over 100% in Q1 2021.

During the first quarter, however, the percentage of Bitcoin supply owned by whale addresses with over 100K Bitcoin increased by 200 percent (or 3x). According to Santiment, an on-chain data provider:

“The percentage of #Bitcoin‘s supply held by whale addresses with 100k or more $BTC has risen from 0.76% 11 weeks ago, to 2.20% today, an 11-month high. Meanwhile, the smaller 1k-100k $BTC addresses have dropped from 42.4% to 39.5% in the same 11 weeks”.

For analyst Lex Moskovski, the type of investor behind such transactions remains uncertain — it could be a private individual or small group, as well as an institutional investor or corporate client.

Related article | Bitcoin whales on the defense, this is how BTC could climb to new highs

“Institutions or not, that’s still a significant outflow,” he commented on the Glassnode data.

The data is consistent with on-chain indicators remaining bullish. This week, Glassnode co-founder Rafael Schultze-Kraft pointed to an increase in Bitcoin’s so-called realized limit (Rcap), which backed up the general purchasing thesis.

The realized limit is a calculation of Bitcoin’s market capitalization based on the most recent price of each coin. It offers valuable information about market composition and trader sentiment, as well as a total that differs greatly from the conventional market capitalization.

Schultze-Kraft tweeted on Friday:

“Unprecedented capital inflows into Bitcoin as measured by realized capitalization. Over the past 6 months, realized cap has surged a whopping $250 billion – an increase of ~200%. Healthy bull market.”

1/ Unprecedented capital inflows into #Bitcoin as measured by realized capitalization.

Over the past 6 months, realized cap has surged a whopping $250 billion – an increase of ~200%.

Healthy bull market.

Chart: https://t.co/c7T5zQzmjc pic.twitter.com/zIdUC2w1nK

— Rafael Schultze-Kraft (@n3ocortex) May 6, 2021

He went on to say that the realized limit has risen by the same amount as Bitcoin’s entire conventional market cap as of December 2020.

Rcap, in comparison to conventional cap, can still rise dramatically until signaling the end of the bull market. MVRV, which calculates the ratio of the two metrics, was 4.4 this week, down from 7.6 in February and more than 10 at previous market cycle peaks.

“We have yet to experience true fomo yet from institutions. It’s coming,” Timothy Kim said in response to the Glassnode numbers.

Grayscale, the world’s largest Bitcoin fund manager, has also expressed interest in converting the Grayscale Bitcoin Trust (GBTC) into a Bitcoin ETF. Following the hype around the first U.S. Bitcoin ETF, shares of the Grayscale Bitcoin Trust (GBTC) have been trading at a discount over the last month.

Related article | How Grayscale Bitcoin Trust at a discount could change everything for BTC

Featured image from Pixabay, Charts from TradingView.com, Bybit.com, and Glassnode.

Source: Read Full Article