The ByBit exchange is one of the most advanced and respected cryptocurrency platforms in the cryptocurrency industry. The exchange is offering a wide range of services including derivatives trading, leverage and inverse trading, among other options.

This is a relatively new platform that became very popular in recent months. This guide about the ByBit exchange will share with you all the details you should know about this platform. We will analyse the fees paid by users, the application and how to use it in different countries.

What is ByBit?

ByBit is a cryptocurrency exchange that focuses on perpetual contracts for cryptocurrencies. Users can trade with leverage up to 100:1 and increase their exposure to digital assets. Thus, the ByBit exchange became a strong competitor to BitMex, Deribit and Binance Futures. These platforms were already established exchanges offering futures trading to users.

The platform is located in Singapore and it has already received different trading and financial licenses to operate in different regions. At the moment, the platform is registered in the British Virgin Islands.

One of the positive things about this exchange is related to the people working on the platform. The exchange has been created by financial experts that have been working in the traditional financial industry for several years now.

Users from all over the world can get access to ByBit. The ByBit exchange is open for most users all over the world. However, ByBit USA users do not have the possibility to use the platform. The United States, Syria, and Quebec are blocked to use this platform. Thus, ByBit US citizens should read the terms and conditions before using the platform.

ByBit Features

The ByBit exchange has a wide range of features that make the platform one of the most advanced for Futures Trading. This ByBit review would go through the main solutions offered by this platform and how they are taking care of their clients.

Trading With Leverage

The first thing that we can mention about the ByBit exchange is related to its leverage possibilities. The platform is allowing traders to increase their exposure to the crypto market by trading with leverage.

Although this can be very risky, expert traders can enjoy trading with a larger size of cryptocurrencies. Users would be able to open 100x trades. What does that mean? That means that if you have $100, you would be able to handle $10,000 in funds. If you open a profitable trade and you close it, then you will get the profits on the $10,000 rather than on the $100. Of course, users need to pay a small borrowing fee.

One of the positive things about the ByBit exchange is that once you open a leveraged position, users can change it. Let’s say that you open a 20x leverage position and the trade moves in the right direction, then you would be able to increase the leverage and take more risk as the trade goes in the right direction.

Perpetual Contracts

In order to trade with leverage on the ByBit exchange, users would have to use their perpetual contracts. These perpetual contracts are considered to be a derivative investment tool that allows users to trade a contract (which price derives from a cryptocurrency) without expiration or settlement date.

Consequently, users can hold their long or short positions open until they consider it is time to close them, or until they get liquidated. Additionally, these contracts follow the price of an underlying asset, in this case, the price of a cryptocurrency such as Bitcoin.

The ByBit exchange uses a dual price mechanism that prevents possible manipulation of the market. Users should pay close attention to the “mark price” – the price that will eventually trigger a liquidation – and the “last traded price” – calculates the price for the position to get closed.

By using both prices, it is possible to reduce the impact of malicious entities in the ByBit exchange. The exchange gathers information from other platforms to get an approximate price value of the digital asset at that time.

Moreover, each contract is worth 1 USD. That means that if you open a $100 USD trade you are going to be handling 100 contracts. It is worth taking into consideration that users should put into practice their risk management techniques. This would allow them to avoid being liquidated or reduce their losses.

Trading Tools

So as for traders to have access to some of the most advanced trading tools, the ByBit exchange is working with different types of orders. Some of them include the following:

- Market Orders

- Limit Orders

- Conditional Orders

- Stop-Entry Orders

- Stop-Loss Orders

- Take Profit Orders

These orders are definitely important for traders to execute their trading strategies. Market orders help users execute their trades immediately at the best available price from the order book. This can be a great option for users that want to enter and exit the market immediately without waiting for the price of an asset to move.

Limit orders do not eat the liquidity from the order book. Indeed, they provide liquidity. They allow the order book to become more liquid and larger. This reduces fluctuations in the market and helps increase liquidity for those that want to immediately sell or buy contracts.

When users trade with limit orders, they can select the price at which they want their order to get executed. For example, they can wait for Bitcoin to reach $50,000 before selling.

A conditional order allows traders to get access to the market if certain conditions are met. If the price to trigger the conditional order is met, a limit or market order will then be executed.

More advanced trading orders include stop-entry orders, stop-loss orders and take profit orders. All of them are available in the ByBit exchange for users to start using them. In the future, it might also be possible for the exchange to add new order types and help advanced traders handle their funds and investments.

Isolated and Cross Margin Trading

You can select cross margin or isolated trader when you are using this platform. Isolated margin means that you would only be trading in a specific position with the margin that you placed in that position. If you have other trades opened, they would not be taken into consideration.

However, if you are trading with cross margin, your other balances (which are linked to other positions) would be taken into consideration. This could be very important to avoid being liquidated beforehand.

Isolated margin is usually very useful for traders that want to control each position they trade. It is easier to set up and you would have a clear overview of the situation. However, you can always set up cross margin trading and start getting advanced features to trade with leverage.

If you don’t feel like to start trading immediately after you create an account, you can always use ByBit testnet. This is a demo account that would allow you to understand how to place orders, change leverage options and improve your trading.

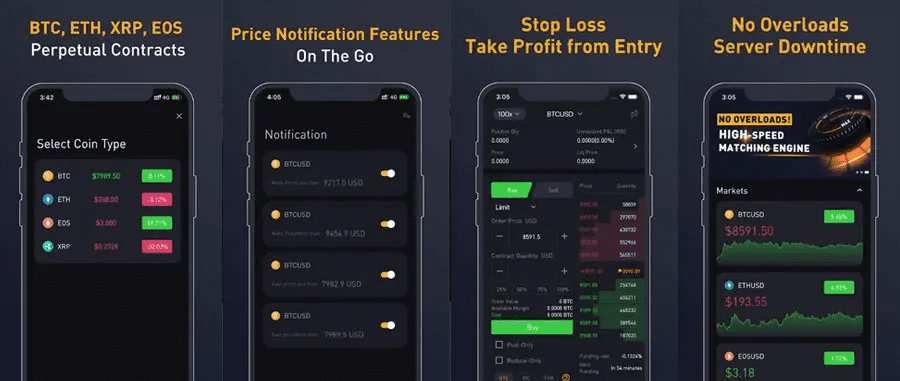

ByBit App

The ByBit exchange has created a dedicated ByBit app that allows users to trade digital assets anywhere. Several exchanges have been adding support for trading apps in order to attract a larger number of users. Additionally, a trading app allows traders to have their funds anywhere they are ready to be traded.

The ByBit app is available for both iOS and Android users. It offers most of the functionalities you might expect to have in the trading platform. Furthermore, you can even start using a wide range of charts also from your phone.

Although the experience is certainly different compared to the desktop application, it can be a good way to have access to the market with your phone anywhere you are.

ByBit Security

Security is one of the most important things when analysing exchanges. Crypto trading platforms allow users to handle large amounts of money, and investors want to know their funds are protected.

In recent years, dozens of crypto exchanges were hacked. They have been affected by attacks in which they lost thousands if not millions of dollars from users. The ByBit exchange has taken several measures in order to protect users funds.

Most of these security features have been tested in the ByBit beta fore they were launched. At the moment, ByBit has the same security standards as most of the largest exchanges in the market.

Multi-Signature and Cold-Storage Wallets

The ByBit exchange is currently using both cold storage and multi-signature wallets. As you might already know, cold storage wallets allow entities (including exchanges and individuals) to hold their digital assets without being connected to the internet.

No attacker or hacker could access through the internet a cold storage wallet. The private keys linked to the wallets of this platform are stored offline. Just a small portion of the funds of an exchange are held in hot wallets (which are connected to the internet). They need these wallets to provide users with liquidity in case they want to withdraw funds.

Additionally, their wallets have multi-signatures. What does it mean? The ByBit exchange would only be able to sign a transaction only if several parties are involved. No single person is in control of the wallet. Several members would have to approve a transaction.

This provides another layer of security. Even if a hacker gets access to the cold wallet in a physical way, he would not be able to execute a transaction unless other users sign it.

Insurance Fund and Encrypted Data

In order to provide further security to users, the exchange has established an insurance fund. This insurance fund would protect users from trading futures contracts in case a trader gets liquidated at a level below the bankruptcy price.

If the ByBit exchange is not able to liquidate a traders position at a bankruptcy price or better, then the insurance fund would start working. In this way, the trader is able to give the borrowed funds back to the lender.

In terms of data encryption, the company works with a full SSL encryption for its website. Thus, you should always control this information when entering the site. If you enter a site that claims to be ByBit exchange and it does not have SSL encryption, then this should be a red flag.

This would help you spot phishing site and possible malicious parties trying to steal users information such as email accounts and passwords. You should always avoid phishing sites and control the URL of the website.

2FA Accounts

Another thing to mention about the ByBit exchange is related to the possibility to add 2-factor authentication. This is an additional feature that users have in order to protect their accounts. In addition to using an email account and a password, you might be required to use Google Authenticator app which would allow you to authenticate your credentials using your phone.

The 2FA can also be activated to withdraw funds or confirm transactions on the platform. In this way, if you don’t have access to your phone you cannot perform any of the major activities on the platform. Thus it protects you from hackers that could have had access to your credentials.

ByBit Fees

Trading fees are definitely important for traders because they allow them to better plan their strategies. The lower the fees, the easiest it is to make profits and maximize their gains. As it happens with most of the exchanges in the crypto market, ByBit exchange uses standard fees when users trade.

That means that every single time an order gets executed, you will have to pay a commission for executing the trade. If you place a limit order, you would not have to pay for it unless it gets executed.

It is worth taking into consideration that limit orders have a rebate. Users are providing liquidity rather than taking it. When a trader places a market order, then liquidity from the order book is taken. These types of orders are usually more expensive than limit orders (liquidity makers).

At the time of writing the fee for market makers (limit orders) stands at -0.0250%, which means that you would get a small rebate in the crypto you are purchasing or selling once the trade gets executed. However, if you open a market order, then you would have to pay 0.075% in fees.

ByBit Exchange Final Words

The ByBit exchange is a platform that is offering derivatives trading for cryptocurrencies. They are offering very attractive fees and the exchange became one of the largest in recent times. Moreover, it is offering solutions to clients from all over the world and it has also a dedicated application for those users that want to trade anywhere they are.

In terms of security, they offer standard services for the crypto market. Onc thing is clear, their derivatives platform is among the best in the market with a wide range of trading orders and several charts and tools that are very useful for traders and analysts.

The registration process is quite simple and users can start using the ByBit testnet (demo account) to understand how to better trade Bitcoin and crypto derivatives in just a few simple steps.

Source: Read Full Article