Tradeweb Markets, a Nasdaq-listed company, announced that the company has formed a partnership with Amazon Web Services (AWS) to enhance data access. The company is using AWS Data Exchange to broaden access to its US Treasury and UK Gilt closing price data.

According to the official announcement, the newly formed collaboration will enable direct accessibility of Tradeweb ICE US Treasury Closing Prices and Tradeweb FTSE UK Gilt Closing Prices through the data exchange of Amazon Web Services. Tradeweb mentioned that it will be available either as a monthly subscription to daily publication data or in the form of historical data sets.

Looking Forward to Meeting You at iFX EXPO Dubai May 2021 – Making It Happen!

Tradeweb aims to facilitate users through the enhancement of data access. The global operator of electronic marketplaces also highlighted the importance of efficient and personalized digital solutions.

Commenting on the latest announcement, Lee Olesky, CEO of Tradeweb, said: “In today’s environment, market participants want more than a one-size-fits-all approach when it comes to accessing data. They’re looking for agile, enhanced solutions that will keep pace with the constantly evolving digital landscape. This collaboration is an important step towards the broadening of access to Tradeweb data through the use of cloud-based services, and we’re excited for the road ahead.”

Earlier this month, Tradeweb posted trading metrics for March 2021. The company saw a record average daily volume (ADV) of more than $1 trillion in March 2021. The total trading volume for the month reached $24.7 trillion across all markets.

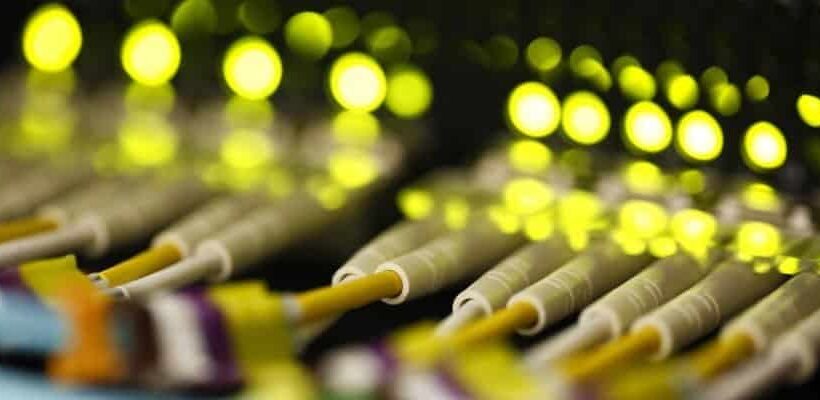

AWS Data Exchange

Additionally, Tradeweb highlighted the importance of a direct distribution channel to reduce the barriers in the entire process of data retrieval. “Tradeweb supplies vital data to a broad set of financial market participants across the globe. We’re pleased to work with Tradeweb to make end-of-day reference prices available on AWS Data Exchange. The availability of this data will help our mutual customers seamlessly feed their trading and portfolio management applications, risk analytics and pricing models running on AWS,” Noah Schwartz, General Manager at AWS Data Exchange mentioned in the official press release.

Source: Read Full Article