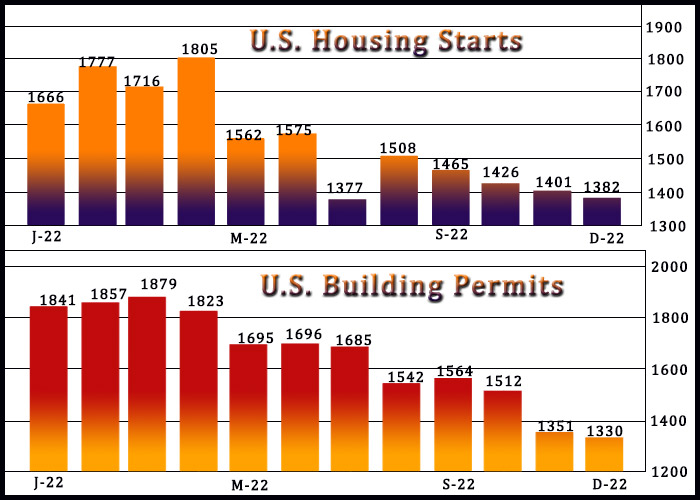

New residential construction in U.S. fell for the fourth straight month in December, according to a report released by the Commerce Department on Thursday, although the decrease was much smaller than expected.

The report said housing starts slumped by 1.4 percent to an annual rate of 1.382 million in December after tumbling by 1.8 percent to a revised rate of 1.401 million in November.

Economists had expected housing starts to plunge by 4.8 percent to an annual rate of 1.359 million from the 1.427 million originally reported for the previous month.

The extended decline in housing starts came as a surge in single-family starts was more than offset by a nosedive in multi-family starts.

While single-family starts spiked by 11.3 percent to an annual rate of 909,000, multi-family permits plummeted by 19.0 percent to an annual rate of 473,000.

The Commerce Department said building permits also dove by 1.6 percent to an annual rate of 1.330 million in December after plummeting by 10.6 percent to a revised rate of 1.351 million in December.

Building permits, an indicator of future housing demand, were expected to jump by 2.1 percent to an annual rate of 1.370 million from the 1.342 million originally reported for the previous month.

The unexpected decrease in building permits came as a steep drop in single-family permits more than offset a sharp increase in multi-family permits.

Single-family permits plunged by 6.5 percent to an annual rate of 730,000, while multi-family permits shot up by 5.3 percent to an annual rate of 600,000.

“The more forward looking permits data suggest further softness in starts Q1,” said Nancy Vanden Houten, U.S. Lead Economist at Oxford Economics. “However, after declining nearly 22% in 2022, we think the worst of the downturn in housing construction is behind us.”

On Wednesday, the National Association of Home Builders released a separate report showing an unexpected improvement in homebuilder confidence in the month of January.

The report said the NAHB/Wells Fargo Housing Market Index climbed to 35 in January from 31 in December, while economists had expected the index to come in unchanged.

With the unexpected increase, the index rebounded from its lowest reading since mid-2012, with the exception of the onset of the pandemic in the spring of 2020.

Source: Read Full Article