WASHINGTON (Reuters) – Climate change risks and increasing access to credit are among the issues President Joe Biden is expected to discuss in a meeting with the administration’s slate of U.S. financial regulators on Monday, the White House said.

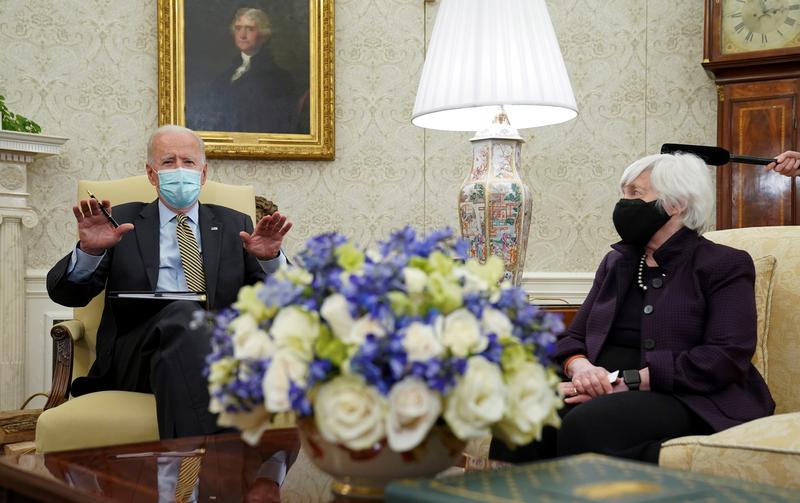

White House officials said Treasury Secretary Janet Yellen, Federal Reserve Chair Jerome Powell, acting Comptroller of the Currency Michael Hsu, as well as the heads of the Commodity Futures Trading Commission, Securities and Exchange Commission, and the Consumer Financial Protection Bureau, would be among those participating in the meeting.

The meeting marks Biden’s first face-to-face encounter with many of the leading federal regulators of the banking industry and financial markets, including Powell. The Fed chief was appointed by former President Donald Trump.

Biden is seeking to use trillions of dollars in government spending to prod a strong rebound from the coronavirus-triggered recession that put millions of Americans out of work.

A nearly 12% gain in the S&P 500 stock index this year has helped fuel hopes of a strong recovery, but markets are closely watching rising inflation expectations and government borrowing costs for signs of trouble.

Biden will meet privately with the officials in the Oval Office at 1:45 p.m. EDT (1745 GMT), the White House said in a daily schedule.

It said the meeting will include “an update on the state of the country’s financial system and institutions” and “cover regulatory priorities including climate-related financial risk and agency actions to promote financial inclusion and to responsibly increase access to credit.”

Biden issued here an executive order in May pushing federal agencies to encourage full disclosure of often-hidden climate-related risks to banks, other financial institutions and the federal government.

Source: Read Full Article