New York (CNN Business)Move over, Robinhood, here comes Goldman Sachs.

The prestigious investment bank, known mainly for advising the affluent how to manage their money and for helping to engineer big deals on Wall Street, unveiled a new robo-adviser Tuesday for the average investor.

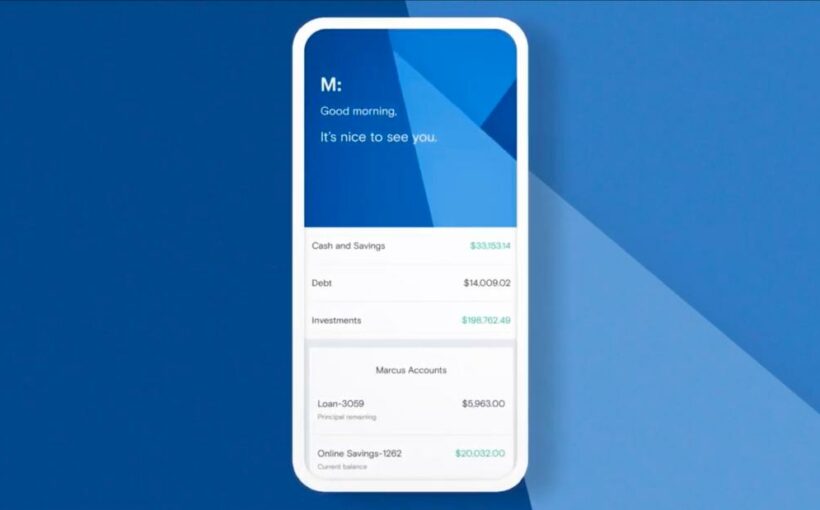

Marcus Invest, an offshoot of the company’s Marcus retail banking arm, will let Goldman Sachs customers buy exchange-traded funds with as little as $1,000.

Goldman Sachs (GS) will not be recommending specific stocks, though, even as Robinhood, Webull and other online brokerages have become popular places for traders to place bets on so-called “meme” stocks like retailer GameStop (GME) and movie theater chain AMC (AMC).

“You’ll have exposure to a range of industries and economies so you have multiple opportunities for growth and won’t be tied to the fate of a single stock,” Marcus Invest said on its website.

In that respect, Marcus Invest seems geared more toward passive investors looking to plan for retirement of other long-term goals as opposed to active traders on the Reddit WallStreetBets board seeking to make a quick buck by betting on individual stocks or cryptocurrencies such as bitcoin (XBT).

Marcus Invest also said that it will monitor portfolios daily and automatically rebalance accounts to keep them on track with longer-term goals.

Goldman Sachs is making a big bet on Marcus to diversify and reach new customers. The asset management and investment advisory business is increasingly targeting younger customers that want to take more responsibility for their own finances as well.

Other brand name financial firms are also taking on services like Robinhood and Webull, which have helped popularize zero commission trading accounts.

Charles Schwab (SCHW) now owns TD Ameritrade while Morgan Stanley (MS) has acquired E-Trade. Mutual fund giant Fidelity also has an online brokerage.

The launch of Marcus Invest is just the latest move by Goldman Sachs to bolster the unit further.

Goldman Sachs announced last month it was partnering with card issuing company Marqeta, which the investment bank has a stake in, to begin offering digital checking accounts to Marcus customers later this year.

Goldman Sachs also said in January that it is collaborating with MasterCard (MA) to issue General Motors (GM)-branded credit cards. The bank is already partnering with Apple (AAPL) on the iPhone maker’s Apple Card.

Source: Read Full Article