A Budget for growth, Jeremy? OBR warns 44,000 small firms will deliberately cut annual revenue by £350m to avoid having to register for VAT amid EIGHT-YEAR freeze in threshold

- OBR says huge number of small firms will curb revenue to avoid VAT threshold

More than 40,000 small firms will deliberately cut revenues due to the eight-year freeze in the VAT threshold, according to the Treasury’s own watchdog.

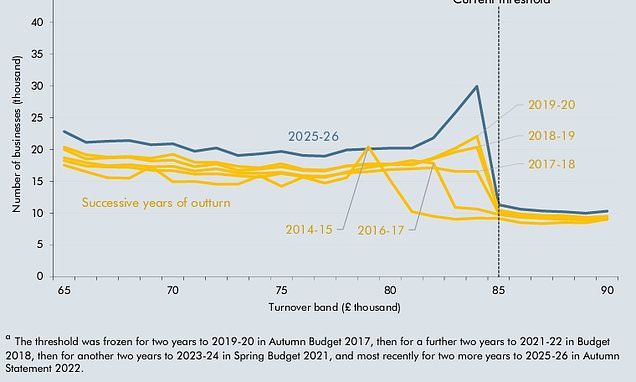

The OBR has warned of increasing ‘distortion’ being caused by the plan to hold the turnover level for registration at £85,000.

The pause began in 2017-18, and by the time it is due to end in March 2026 some 44,000 are expected to be ‘capping’ their income to avoid the red tape of joining the VAT system.

The firms – likely to be mostly sole traders – will be forgoing a total of £350million a year in revenues, according to the watchdog’s estimates accompanying the Budget.

The details will raised fresh questions about Jeremy Hunt’s claim to be pushing for growth – while at the same time using ‘fiscal drag’ to bring in huge sums in tax to balance the government’s books.

The OBR has warned of increasing ‘distortion’ being caused by the plan to hold the turnover level for VAT registration at £85,000

The firms – likely to be mostly sole traders – will be forgoing a total of £350million a year in revenues, according to the watchdog’s estimates accompanying the Budget

Millions of people are being dragged into higher rates of income tax due to thresholds being frozen in cash terms while inflation surges.

The threshold at which companies have to register for VAT reached £85,000 in 2017-18.

The OBR said that it forecast freezing the level will be raising an extra £1.4billion a year by 2027-28, as the number of firms in the system will be 169,000 higher than if it had lifted in line with RPI inflation.

But the watchdog’s report said: ‘Given the administrative burden and pricing consequences of being subject to the VAT regime, the registration threshold also creates an incentive for firms to cap their annual turnover just below it.

‘And freezing the threshold while firms’ turnover rises due to inflation means that over time, while more firms become subject to VAT and more revenue is raised, there are also more firms that pile up against the threshold by capping their turnover.’

The OBR said there had always been some ‘bunching’ of firms just below the threshold.

But it added that since 2017-18 ‘the scale of the distortion below the threshold has been increasing’.

Spelling out what it believes will happen to the ‘distortion’ by 2025-26, the report said: ‘Relative to 2017-18, the number of firms capping their turnover is expected to have almost doubled from 23,000 to 44,000.

‘And relative to a smooth distribution of firms by size, the lost turnover associated with this distortion among these traders is expected to have risen from £110million to £350million.’

The details will raised fresh questions about Jeremy Hunt’s (pictured) claim to be pushing for growth – while at the same time using ‘fiscal drag’ to bring in huge sums in tax to balance the government’s books

Source: Read Full Article