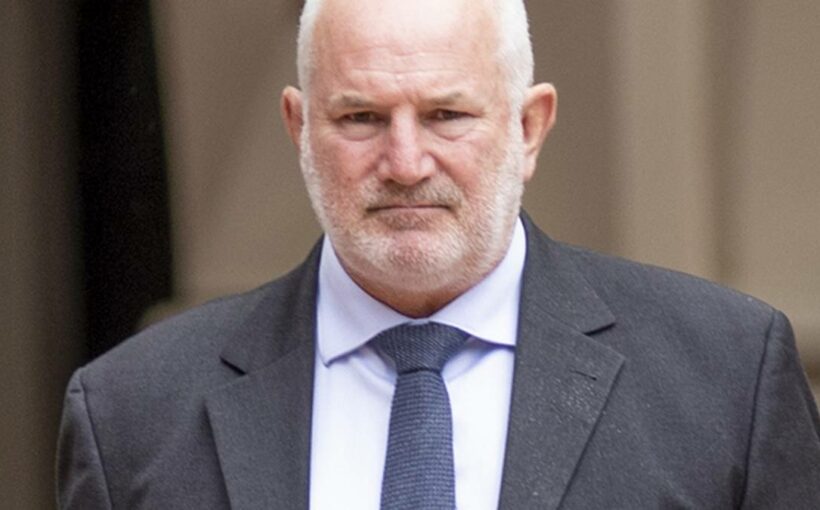

Auckland businessman Greg Olliver claimed $8 million was owed to four of his companies yet he offered no documentary evidence to back up the alleged debt, officials allege.

The claim was lodged by Olliver, an Auckland property developer who is currently banned from directing companies, after he became aware a multi-million dollar payout was to be made in the liquidation of another of his firms, BBG Holdings Ltd.

If the debt had been accepted, Olliver’s entities would have received a share of the $3.6m. Instead, it was rejected by liquidator Damien Grant of Waterstone Insolvency.

A Companies Office report obtained by the Herald through the Official Information Act claimed Olliver “was alive to commercial benefits that would derive from the existence of a loan”.

Olliver was banned as a company director in October after the Companies Office investigated the reasons for the collapse of BBG Holdings. The banning order followed the report from the Deputy Registrar of Companies which found instances of “mismanagement” by Olliver that led to its failure.

The report said there had been no documentary evidence provided to show a loan existed. “[Olliver] can’t point to any signed loan agreement. Nor can he point to any meetings or resolutions that would have been required by both borrower and lender before any loan agreement was entered into.”

There were also no details as to when the money was loaned and no assets in BBG Holdings to underwrite any loan that was made.

The report said “there is nothing to show the existence of any money having passed through BBG’s bank account”. “And if $8 million had been lent to BBG, where did it go to?”

The Herald has sought comment from Olliver on the banning report and he has not responded. The report said Olliver had “acknowledged no wrongdoing and expressed no remorse”.

In it, the circumstances of the loan claimed by Olliver were detailed making it the third official document to have recorded the property developer’s claim of being owed $8m.

Along with the Companies Office inquiry, Grant’s formal liquidation report of September 2020 recorded he had “reviewed and rejected” claims of $8m from entities connected to Olliver. Grant did accept one claim of debt of around $70,000.

Until that liquidation report, a year after BBG Holdings went into liquidation, the company was believed to owe $880,000, with $850,000 owed to an earthworks company hired to do work on a development in St Heliers and $30,000 to Inland Revenue.

Then in a High Court judgment from July 2021, Grant detailed in evidence how he had repeatedly told Olliver a year earlier that proof of the debts was needed and that spreadsheets claiming $8m was owed wasn’t enough.

The judgment recorded evidence of Olliver claiming the $8m debt with “draft financial statements … supported by unsigned financial statements”. Grant testified that when he told Olliver the $8m claim would be rejected, the property developer told the liquidator “he would ensure that BBG’s claim [for $850,000] in the CIT liquidation would be rejected”.

The judgment recorded how Olliver then approached the liquidator of CIT Holdings, KPMG, with his view that the claim by BBG Holdings for the $850,000 in earthworks should now be rejected.

It was a claim BBG Holdings had made before it went into liquidation and when Olliver was sole director of the company. It was also before CIT Holdings, in which he was also sole director, went into liquidation.

Associate Judge Rachel Sussock said the evidence showed the $850,000 invoices were issued in 2014″immediately the earthworks were done between companies with the same director” and “were not rejected by CIT at the time or for the next several years until the liquidators determined to reject the claim”.

Grant had gone to court to overturn KPMG’s decision to reject BBG Holdings’s claim for $850,000, having previously accepted it.

Associate Judge Sussock said it was “surprising” the liquidators of CIT Holdings did not reconsider its position particularly “where a request was made by Mr Olliver so late in the liquidation and where the reversal of the liquidators’ position would be likely to result in entities associated with Mr Olliver receiving a greater distribution than otherwise”.

The judge’s comments were made in a ruling in which she told KPMG it had to stand by its original decision to accept the $850,000 claim for which “there is a credible factual basis”.

She said it was consistent with documents from the time and with invoices when Olliver was sole director of both companies. “It was only after a request from Mr Olliver that the claim was reconsidered.”

She said “the decision by the liquidators to reject BBG’s claim is a decision that no reasonable liquidator could have come to and must be reversed”.

The Companies Office investigation that led to Olliver being banned focused on the failure of BBG Holdings and was centred on its connection to development of multi-million dollar neighbouring properties on Waimarie St in St Heliers.

The properties included the former family home of Greg Olliver during his marriage to public relations specialist Sarah Sparks. Olliver had sought to develop the properties since buying the land in the late 1990s and early 2000s.

The $850,000 debt for the earthworks was one point on which the Companies Office focused, alleging that Olliver’s decision to verbally contract to $1.8m of work was “mismanagement”.

It was also critical of Olliver’s decision to put BBG Holdings into debt by having earthworks done on land the company didn’t own.

Olliver argued to the Companies Office that BBG Holdings had a deal to buy the land and a “reasonable belief” it would go ahead.

The Companies Office report said this view was “foolhardy” as it needed Sparks to lift caveats she had placed as part of divorce proceedings.

The Companies Office report claimed “a reasonable and prudent company director” wouldn’t tie a company to spending on land it didn’t own without – at least – an unconditional contract to purchase.

Earthworks company JG Civil wasn’t paid for the $850,000 worth of work it had done despite Olliver’s assurance the money was budgeted and available, the report said. It went on to describe a circular loop in which BBG Holdings needed funding to pay for the work from the BNZ but needed the engineer’s report to unlock the funds – and an engineer’s report wasn’t complete when the works went ahead.

“The problem for BBG was it had not adequately done its homework before it got JGC to undertake the work,” it said.

The report also alleged the company had traded while insolvent – and done so since 2014, five years before it was placed into liquidation. It had hired JGC to do work “without any income to pay for it” and no evidence had emerged to show “ever considered the interests of the creditors”.

The report said “it is clear [Olliver] wanted to develop the Waimarie property”. “He also wanted to ensure that he could enjoy the fruits of that labour without having his ex-wife having any share of those fruits or for her to have any influence or control in the development,” the deputy registrar wrote.

The report said Olliver “in seeking to achieve his ends, chose to do so through company vehicles”. “And in doing so, [Olliver] was required to separate his personal interests from the duties he owed the Company and its creditors. There is no evidence [Olliver] did so.

“The evidence demonstrates [Olliver] either cannot understand that his personal interests do not equate with the interests of the company, or else he has disregarded it.”

Olliver’s company structures had previously been described in a court judgment as “conducted through a convoluted legal structure of trusts and companies apparently designed to protect assets from creditors and minimise taxation liability”.

BBG Holdings was one of dozens of companies that Olliver had registered with the Companies Office and included nine entities identified by a Herald investigation that had gone into receivership or liquidation since 2009 with creditor claims of $42.5m.

A company to which Olliver is connected – and was director until the banning order – was currently working on a development plan to turn a Whangapāroa golf course into a large subdivision. Like Olliver’s other companies, it now had to do so without him as a director and with the banning order barring him from taking part in any management decisions.

Source: Read Full Article

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/YH7F5EYCNY5Z53VS2NHHHXNQTE.jpg)

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/C5A4Q42DUXR6742MJ6HCJ7XNDA.png)

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/ND6SPZFKXJD3UTYGBRKOCBTJ34.png)