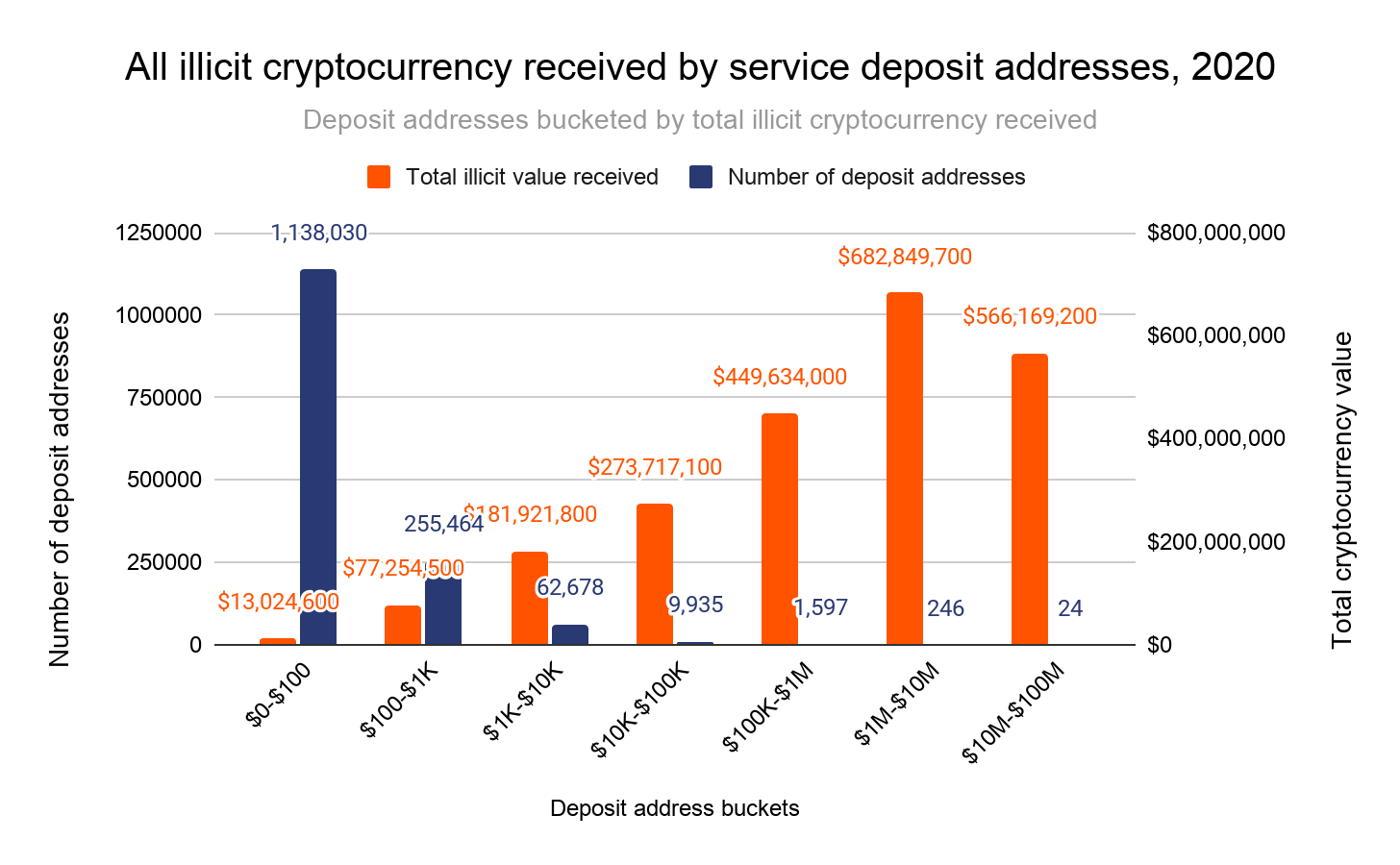

A majority of digital currency money laundering is facilitated by a surprisingly small number of service providers and wallet addresses. A new report from Chainalysis took a deep dive into the flows of illicit digital currency transactions and discovered that 270 wallet addresses were the recipients of 55% of all illicit digital currency transacted; Overall, the group of 270 collectively received $1.3 billion worth of illicit digital currency.

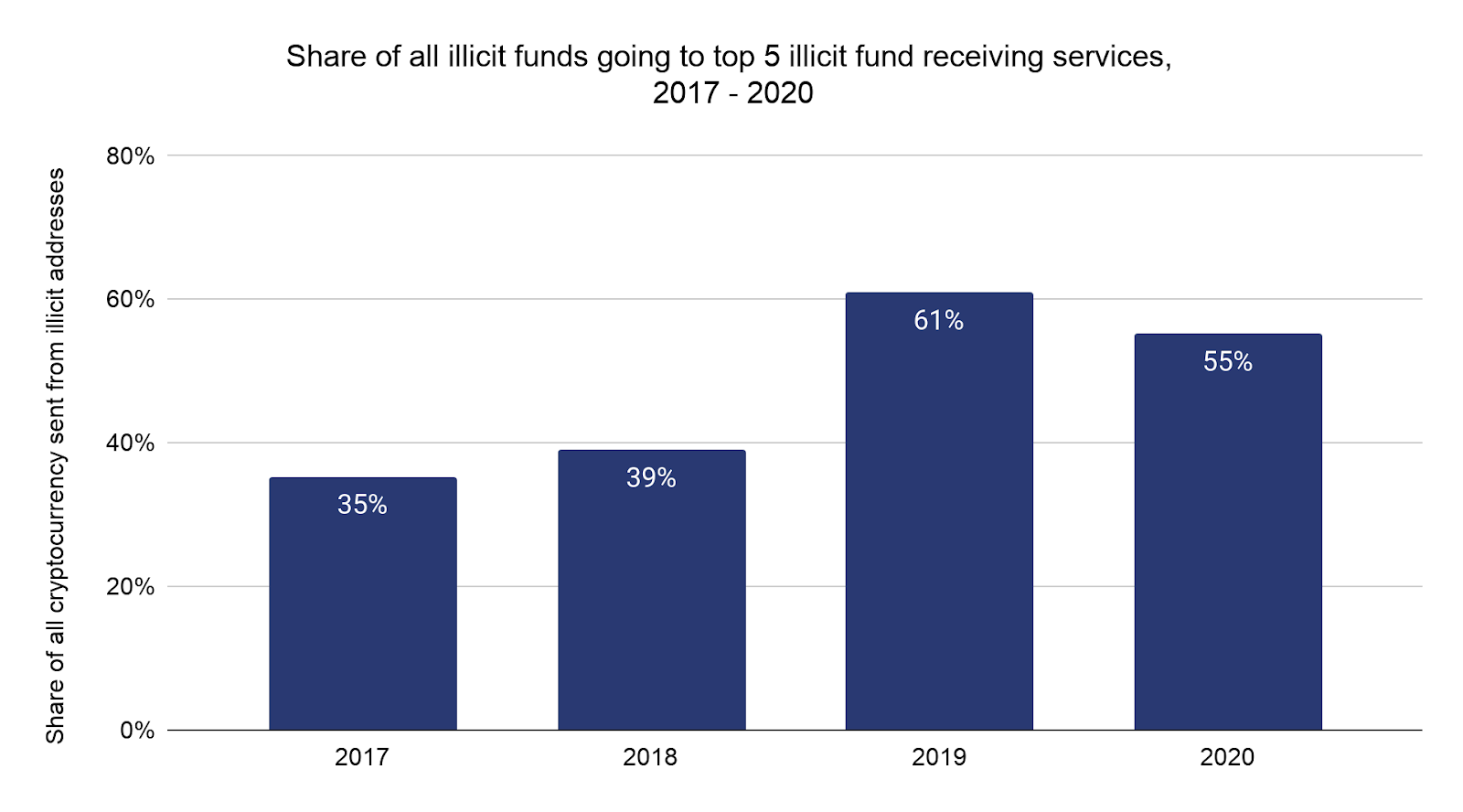

Interestingly, 55% of all illicit funds transacted were laundered through the top five digital currency money laundering services. “Overall, what the data makes clear is that most illicit funds travel to service deposit addresses for whom money laundering makes up a huge portion of their activity, to the point that many of them appear to have no other purpose,“ said Chainalysis in its 2021 Crypto Crime Report.

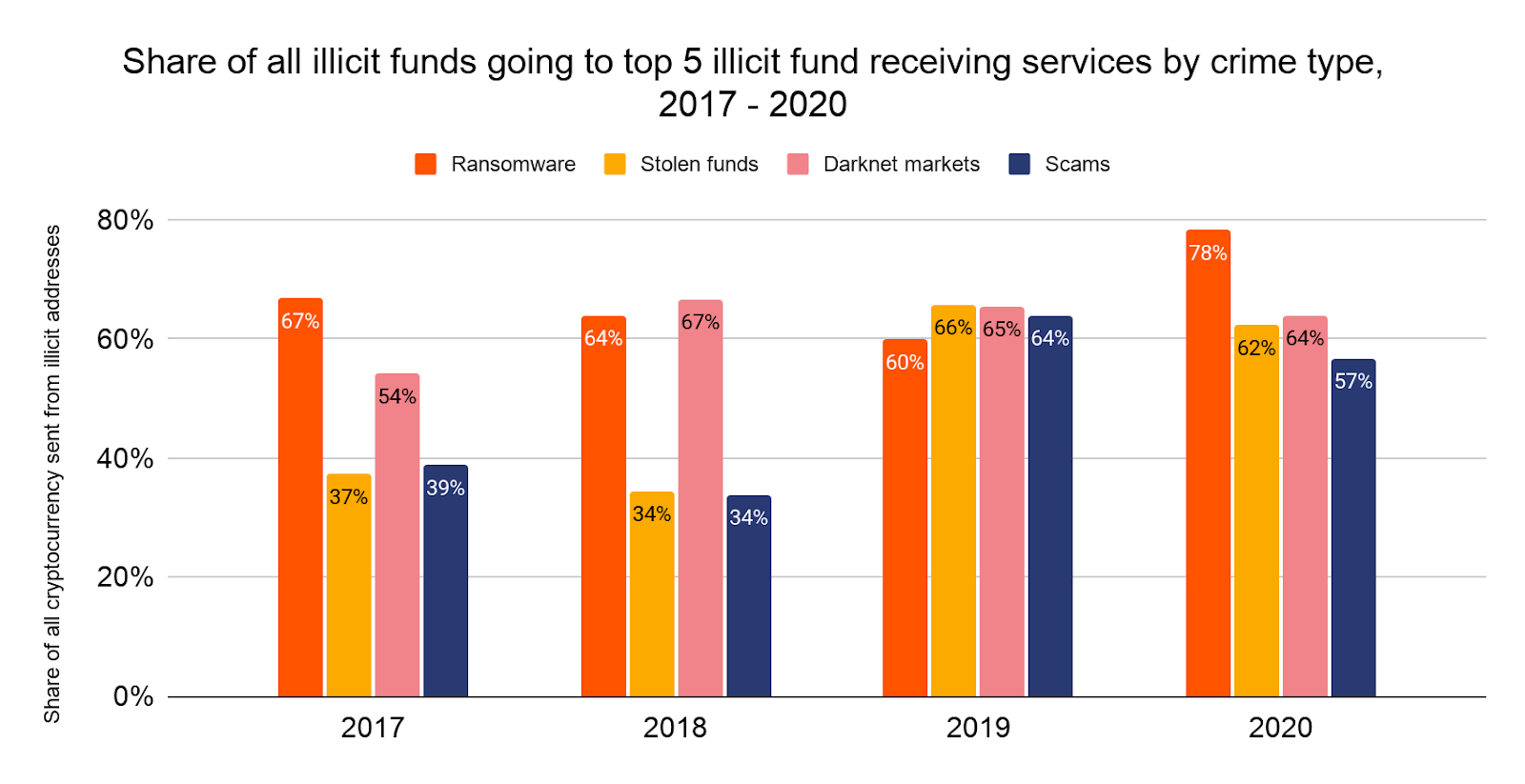

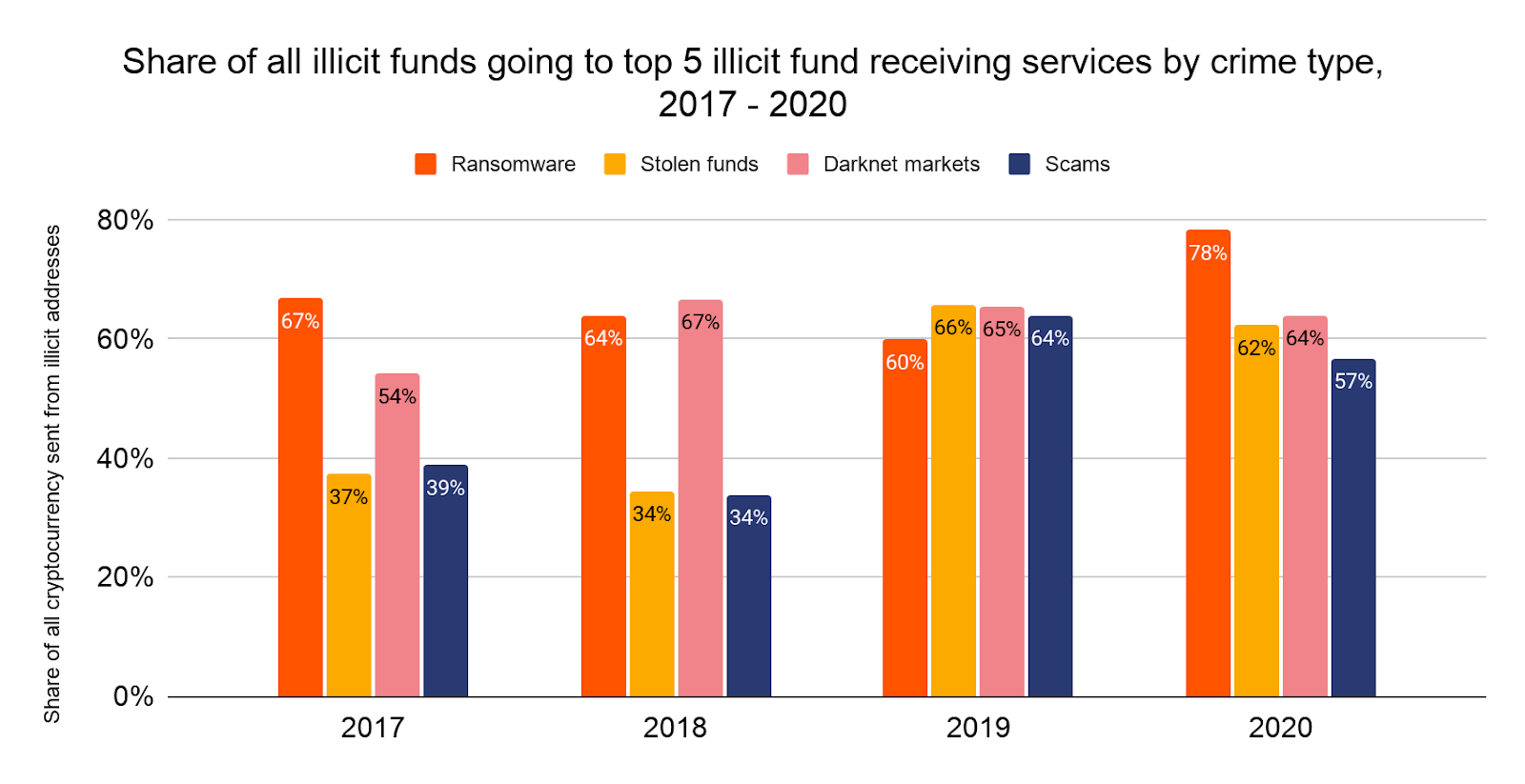

Most of the illicit funds come from criminals executing ransomware attacks, followed by money that comes from darknet markets, funds that have been stolen due to a hack or exploit, and funds that come from scams.

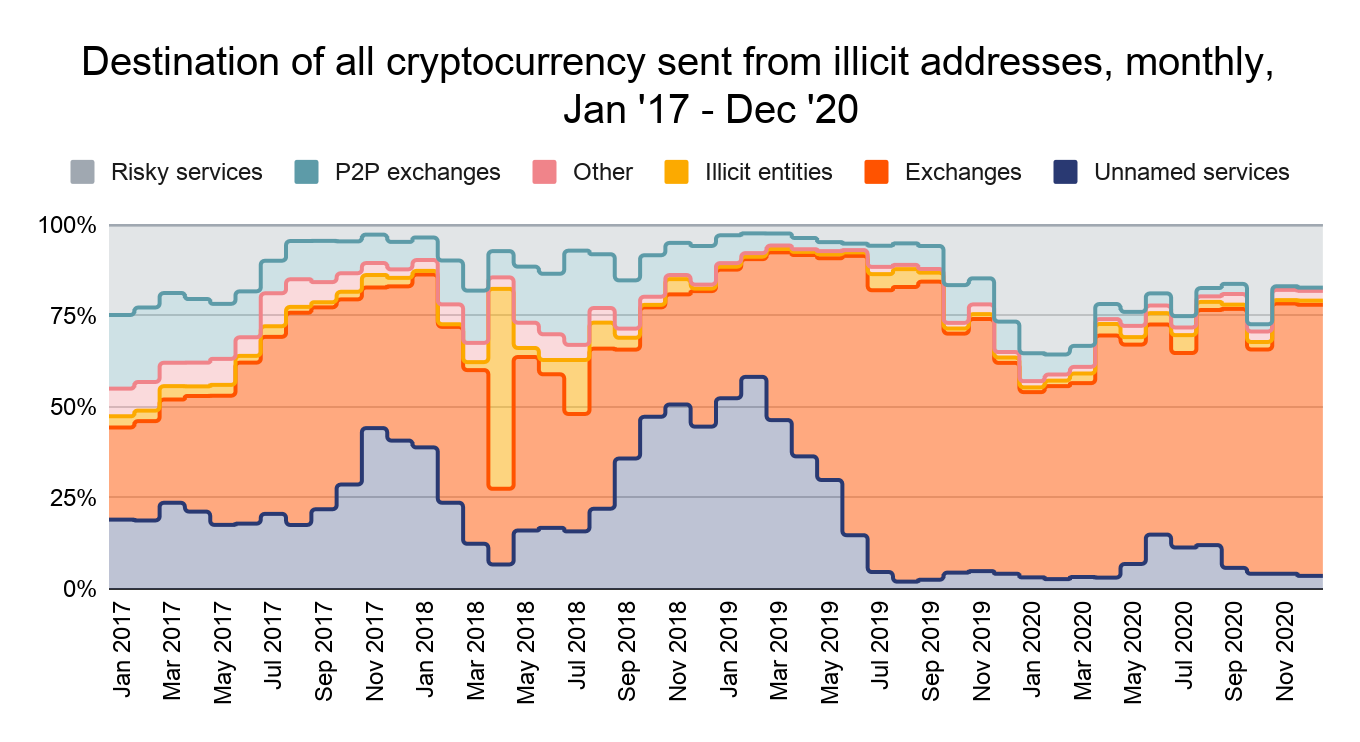

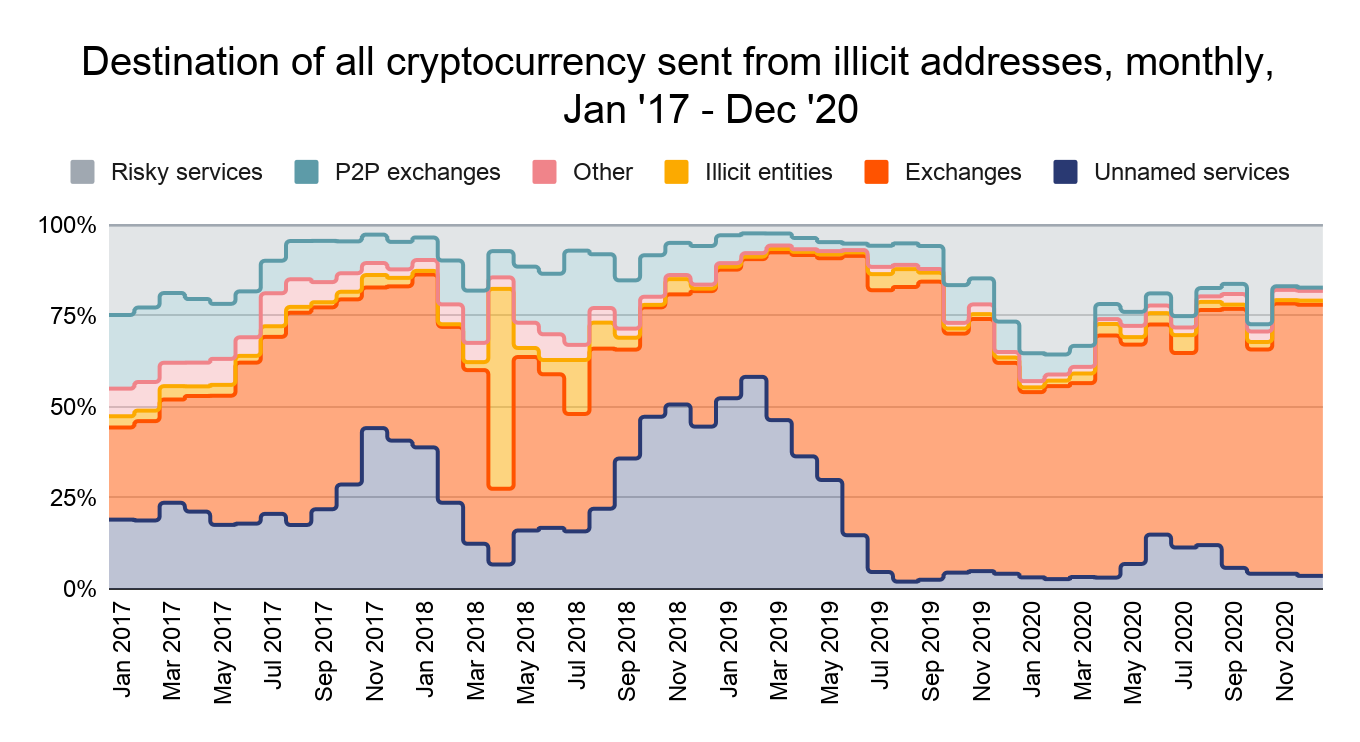

And despite their being popular money-laundering service providers, a significant amount of illicit funds are sent to legitimate digital currency exchanges.

“A smaller but still significant portion also goes to deposit addresses doing a high volume of legitimate transactions, which could allow the illicit activity to fly under the radar, reinforcing the need for compliance professionals and investigators to stringently assess all deposit addresses,” said Chainalysis.

Throughout the report, Chainalysis emphasizes the need for investigators and law enforcement officials to take a closer look at some exchange addresses that are known to be associated with money launder. Chainalysis believes that scrutinizing these wallet address holders and the service providers that host the wallet addresses would deter criminals from using digital currency to facilitate crime.

“Law enforcement could significantly hamper cybercriminals’ ability to convert cryptocurrency into cash by identifying and prosecuting the owners of these deposit addresses,” said Chainalysis. “In addition, this shows that the services hosting these deposit addresses, most of which belong to nested services, need to be more diligent in their transaction monitoring. They too could make the cryptocurrency ecosystem safer by cracking down on the worst offenders.”

You can learn more about illicit transaction flows, their final destinations, the percentage of illicit transactions that each country accounts for, and more in Chainalysis’s 2021 Crypto Crime Report.

If you are looking for high-level overviews of the reports that come out of Chainalysis, then you are going to want to check out the CoinGeek Chainalysis Tag!

Source: Read Full Article