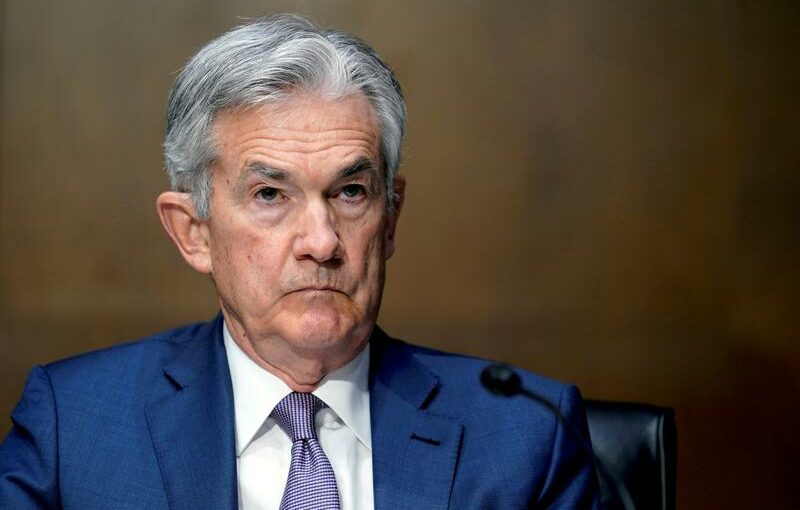

WASHINGTON (Reuters) – The U.S. economy is doing better but is “not out of the woods yet,” Federal Reserve Chair Jerome Powell said on Monday in remarks that flagged an upcoming central bank study documenting the disproportionate blow suffered by the less educated and working parents during the coronavirus downturn.

“The economy is reopening, bringing stronger economic activity and job creation,” Powell said in remarks prepared for delivery at a conference of the National Community Reinvestment Coalition. “That is the high-level perspective – let’s call it the 30,000-foot view – and from that vantage point, we see improvement. But we should also take a look at what is happening at street level.”

There, Powell said, the Fed’s annual Survey of Household Economic Decisionmaking (SHED), to be released later this month, put some firmer estimates around the disparate impacts of the pandemic, an issue he and other policymakers have focused on and pledged to build into their analysis of how the economic recovery is proceeding and when it might be complete.

The report found that 22% of parents “were either not working or working less because of disruptions to childcare or in-person schooling,” with the numbers even higher for Black and Hispanic mothers, at 36% and 30% respectively.

About 20% of people aged 25 to 54 – the prime working years for U.S. adults – without a four-year college degree were laid off in 2020, versus 12% for those with at least a bachelor’s degree.

About 14% of whites in their prime working years were laid off at some point last year compared to 20% or more for Blacks and Hispanics in that group, Powell said.

The SHED report is an important annual benchmark of household economic health, and will be watched closely when it is released later this month for signs of possible longer-term damage from the pandemic.

Conditions are changing fast – more than 900,000 jobs were added in March and a Reuters poll of economists forecasts close to a million in April. But the Fed is watching closely to see if the gaps are beginning to close across U.S. demographic groups, and within industries such as leisure and hospitality that saw the biggest job losses early on.

“We view maximum employment as a broad and inclusive goal,” Powell said, repeating the new priority the central bank has given to encouraging more job growth at the risk of higher inflation.

Source: Read Full Article